Pressure on used car market leads to increase in personal property taxes

The value of a car went up in the past year causing a personal property tax increase for car owners in Missouri.

Continue Reading

The value of a car went up in the past year causing a personal property tax increase for car owners in Missouri.

Continue Reading

OSAGE BEACH, Mo. (KMIZ) Voters in Camden and Miller counties voted against a 30-cent increase for every $100 of value. That money would have funded new equipment and a new location for the fire department to reduce response times. The new location of the fire department would have been a mile and a half away

Continue Reading

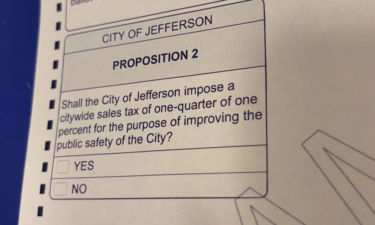

Jefferson City voters will have the opportunity next Tuesday to vote on approving or rejecting a quarter of one percent sales tax to improve public safety.

Continue Reading

OSAGE BEACH, Mo. (KMIZ) Camden and Miller Counties will vote on Tuesday, November 2nd, on a proposed tax that would pay for new fire equipment and a new fire station. The property tax increase will cost residents 30 cents for every 100 dollars of property value. That would cost property owners $114 a year on

Continue Reading

Missouri’s sales tax holiday is underway in the Show-Me State, as the holiday by state law is set to begin the first Friday of August and run through the following Sunday.

Continue Reading

Camden, Cole and Callaway Counties all held special elections Tuesday, allowing voters to decide on various tax increases throughout the districts.

Continue Reading

The IRS began Thursday to deposit advance payments on this year’s expanded child tax credit into Americans’ bank accounts.

Continue Reading

The bill now heads to Gov. Mike Parson’s desk.

Continue Reading

COLUMBIA, MO (KMIZ) The homeless population has the ability to receive stimulus checks. The IRS offers a free tax filing tool on its website allowing for unhoused people who make less than $72,000 annually to file easily. The department also offers free tax prep help for those in need, which will provide options for tax

Continue Reading

COLUMBIA, MO (KMIZ) The third rounds of stimulus check payments are expected to hit many American’s bank accounts Wednesday morning, many are tracking the status of payment along with tax refunds. Thursday, President Joe Biden signed the $1.9 trillion COVID Relief Bill. The bill included up to $1,400 direct payments for most Americans. This is

Continue Reading

A bill that would allow state and local governments to collect online sales tax from companies without a physical presence in Missouri could win House approval as early as Thursday.

Continue Reading

COLUMBIA, Mo. (KMIZ) The IRS has started accepting tax returns Friday. It may seem early but it’s later than usual this year. You can typically file in the second half of January, though many don’t have the necessary documents by then. The IRS had to delay tax season because it dedicated resources to the second

Continue Reading

Swift Prepared Foods is looking for a new location for an Italian meats processing plant to open in 2022. And the company is considering Columbia.

Continue Reading

This tax season experts are warning the public about signs that they’ve been victims of identity or tax fraud with a pandemic-related twist.

Continue Reading

The Columbia City Council will meet at 5 p.m. for the pre-council meeting Monday to begin discussions about the fiscal year 2021 budget.

Continue Reading

It’s possible that Missourians have begun preparing their 2019 income tax return, however, thousands have complained about not yet receiving their 2018 refund from the Missouri Department of Revenue.

Continue Reading

Director of Columbia Parks and Recreation, Mike Griggs, spoke with the Disabilities Commission Thursday about ADA compliance at the Boone County Fairgrounds

Continue ReadingThe Missouri Department of Revenue has paid taxpayers significantly more in interest from late tax refunds so far this year, according to a department spokesperson. The department has paid about more than $1,372,059.07 since January as part of the 2018 tax season, compared to $549,468.05, $533,780.73 and $370,306.20 during the same time span in the

Continue Reading