Missouri Budget Project estimates impact of governor’s tax cut plan is nearly $1 billion

Watch the speech live

COLUMBIA, Mo. (KMIZ)

Gov. Mike Parson told a crowd of Columbia residents Monday morning the proposed tax cuts and agricultural tax credits will benefit the local economy, but some budget analysts are skeptical of his claims.

Parson met with Columbia residents and city leaders at the site where the Columbia Farmers Market gets together twice a week. He's touting his plan to extend agricultural tax credits, which Columbia's mayor says helped expand the market. He also wants to cut income tax for all Missourians.

"If there's ever a time to help farmers, now is the time," Parson said. "You know, record diesel prices out there, fertilizer prices, feed prices, just doing business."

Parson stressed the state budget's ability to take the biggest income tax cut in history and still fully fund important programs during his stop on a statewide tour to raise support for his special session plans.

Parson is pushing for an approximately $700 million permanent annual tax cut, taking the top income tax bracket from 5.3% to 4.8% and eliminating the lowest tax brackets. The governor is pairing the tax cut with the extension of certain agricultural tax credits during a special legislative session slated to start after Labor Day.

If the state can't give money back to taxpayers and help one of its biggest industries -- agriculture -- with a record budget surplus, "we need to pack our bags and go home," Parson told an audience at the Clary-Shy Community Park in west Columbia.

"We weathered storms like droughts, like floods, civil unrest, COVID-19, train derailments, tornadoes … we took a balanced approach in this state," Parson said of his tenure. "We tried to keep businesses open, keep people at work, and we’re reaping the benefits of doing that."

The tax cut plan has drawn opposition from Democrats and political groups worried it could drain the state treasury and endanger funding for vital social programs. A permanent tax cut shouldn't be based on a budget surplus bloated by an infusion of one-time funding from the federal government, critics say.

Traci Gleason, the spokesperson for Missouri Budget Project, said Parson's plan is not sustainable.

"We have a rosy revenue picture right now, but what will it look like down the line?" Gleason said.

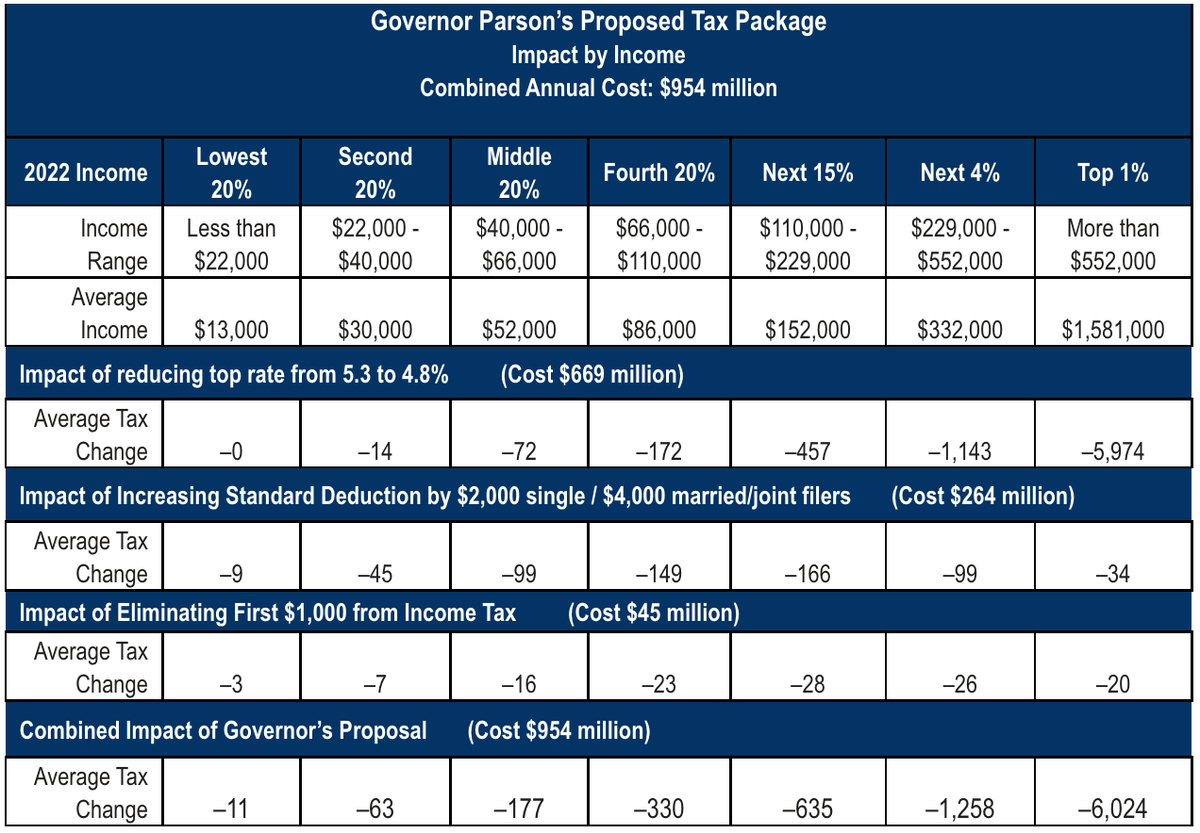

The Missouri Budget Project put together a table with estimates on how the proposed cuts would impact different tax brackets. Gleason said the lowest earners will not see benefits. The total estimated impact of the plan is $954 million which would be taken out of the budget. Parson estimated it would only be around $700 million.

"It is true that federal funds are not being used to fund the tax cut, but federal funds have helped us get to the situation that we are in today," Gleason said.

But Parson on Thursday refuted that notion, touting the ongoing strength of the state economy, including a 20% jump in revenue in June. Parson disputes opponents' claim, saying he is not using one-time federal funds to justify the tax cuts.

"That's just a bunch of political spin on it," Parson said. "We've run the numbers on it, we believe we're gonna be able to sustain this for the long haul."

Parson also stressed that his planned tax cuts will help people of all income levels.

"If you’re drawing a check you’re going to benefit from it," Parson said.

Chamber of Commerce President Matt McCormick says it's too soon to predict how Parson's plan could impact Columbia residents.

"It's one of those things that we're gonna have to watch and see as it goes through its process, and so we're going through the details of it now that it's out and working through that process," McCormick said.