Experts warn against waiting until the last minute to file taxes, with only hours remaining

COLUMBIA, Mo. (KMIZ)

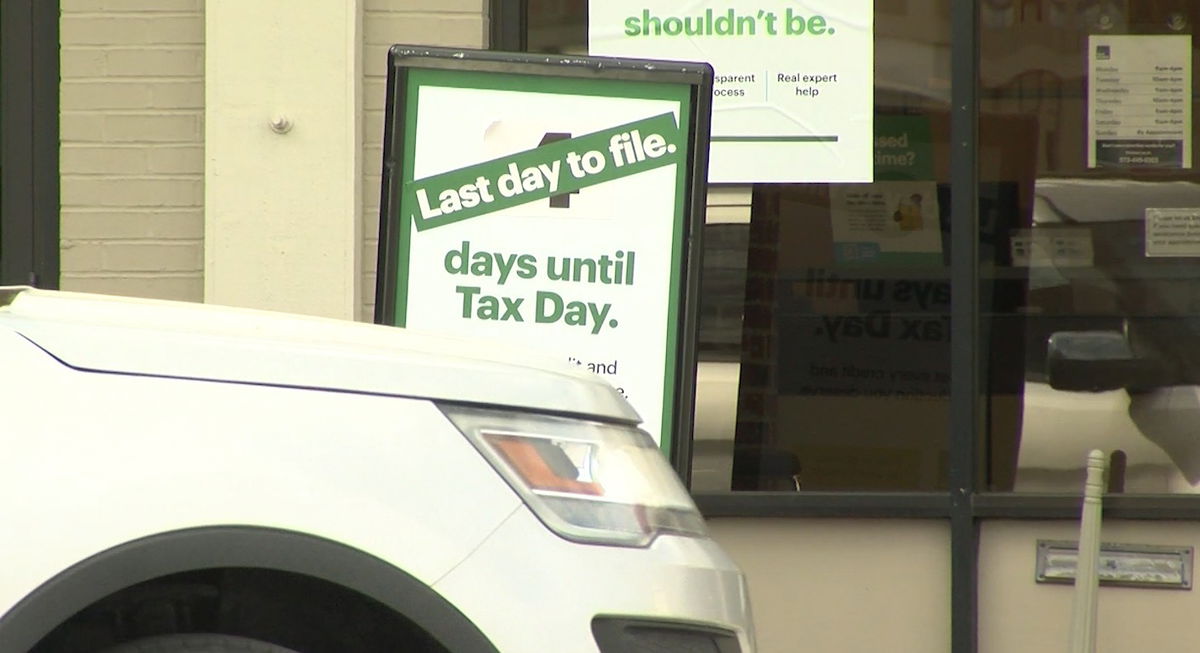

Tuesday is the last day to file, pay, and request an extension to file taxes with the IRS.

As of April 7, the IRS has received 101,320,000 tax returns -- 97,831,000 of which were filed online -- and has processed 100,367,000.

The IRS has refunded $198.868 billion, with the average refund coming in at $2,878, according its online data. As the final hours to file approach experts warn against waiting until the final minutes.

"A lot of problems happen when you wait to the last days or the last day or the last hour," Mark Steber, Jackson Hewitts' chief tax information officer, said. "The primary mistake that most people make is when they hurry to get it done, they often shortcut some of the accuracies and specifics and there's no guessing, no estimating or 'guesstimating' on a tax return."

Steber said taxpaers can accumulate late fees and other penalties for filing late. Late penalties can include paying up to 25% of any taxes you owe, and Steber said there is a separate fail-to-pay-on-time penalty if you don't pay at least 90% of your taxes by the deadline.

Steber said that this year has "been a very uneventful season," compared to previous years, adding that increased IRS staffing, and learned lessons from the past years have made this season easier.

However, taxpayers who have already received their refund were in for a shock, as COVID-19 tax breaks and other COVID-related tax relief programs ended this year. The average refund was down from $3,175 last year.

"There was a lot of refund disappointment, refund shock, and worse than that, balance due trauma," Steber said.

Steber added there is still a need to stay vigilant for fraud and scammers as the tax season comes to a close.

"When people start filing, scammers come out, they also come out these last couple of weeks as people get in a hurry, and then in about three weeks, you'll see another pop," Steber said.

Steber said the IRS will only contact taxpayers through the mail, and will only call or email you if they are contacted first.