Depending on where you teach, it could take 5 to 12 years to repay your debts

Canva

Depending on where you teach, it could take 5 to 12 years to repay your debts

Money laying on top of blue graduation cap with yellow tassel.

For educators, the state they teach in can affect how long it takes them to pay off their loans. In many states, teachers tend to spend years paying off their student loans because their salaries just aren’t as high as other jobs that need the same level of education. Plus, teachers’ paychecks are growing at a different pace than inflation.

While teachers received an average increase of 2.6% in salary from 2022-2023, inflation is at 4% from 2022-2023. When adjusted for inflation, the average teacher is making $3,644 less per year than 10 years ago.

Some salary increases like those in New Mexico and Nevada are higher than others like Vermont and Alabama.

In many states, teachers are not getting paid enough to keep the lights on, keep students educated, and keep their debts paid. And depending on where one teaches, paying off student loans may take a teacher more than twice as long as others.

In this article, TeacherCertification.com sheds light on the duration and costs associated with paying off student loans on a Pay As You Earn Plan as a secondary school teacher across the U.S.

![]()

TeacherCertification.com

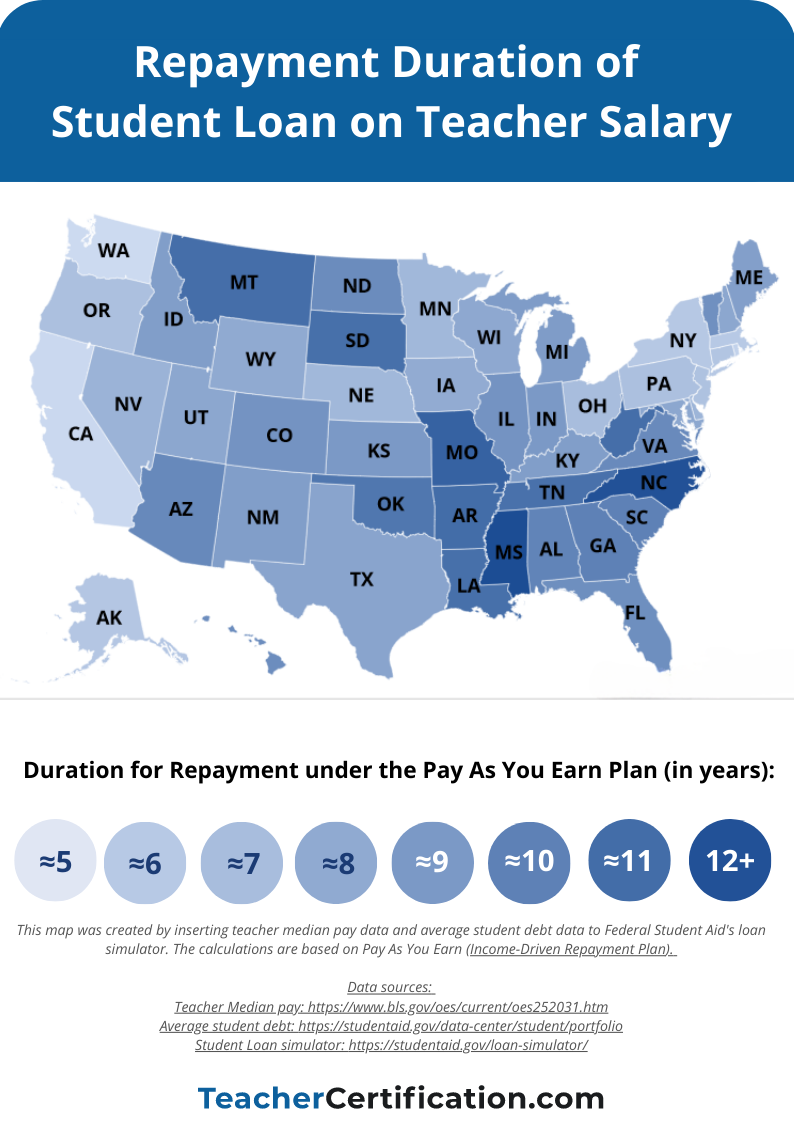

State trends show that repayment duration varies widely

A heatmap of the U.S. that shows how long it takes for teachers in every state to pay off their student debt.

National data suggest that it takes an average of 8.7 years for teachers to repay their debts. However, this can depend on where you teach.

To find out where it takes the longest for teachers to repay their loans, we dove into the numbers armed with the Federal Student Aid’s Loan Simulator. Our mission was to shed light on the interest paid, repayment times, and estimated monthly payments by the average student loan borrower, factoring in the unique circumstances of educators in each state.

We focused on the Pay As You Earn (PAYE) repayment plan, which offers more manageable monthly installments. For the calculations, we used the median salaries for secondary school teachers.

Over half of the teachers incurred a student loan debt of $58,700 in 2020, which exceeds the state averages. It is important to note that not all teachers take out student loans to fund their education. Since there is a lack of state-specific data concerning teacher debt, we’ve utilized the state average student debt amount for our calculations. We also assumed that teachers’ salaries would increase by 5% annually, which is a generous assumption.

The data demonstrates that the states where it takes teachers less time to repay their loans are also the states where teachers are paid the most: California, Rhode Island, Massachusetts, and New York. In all these states, secondary school teachers earn, on average, more than $79,000 a year. With higher salaries, teachers can pay back their loans in 5 to 6 years on a Pay As You Earn Plan.

In states with the lowest teacher pay, which include Mississippi, South Dakota, West Virginia, and North Carolina—where secondary school teacher pay is below $49,000 a year—it takes more than 11 years to pay back the loans.

TeacherCertification.com

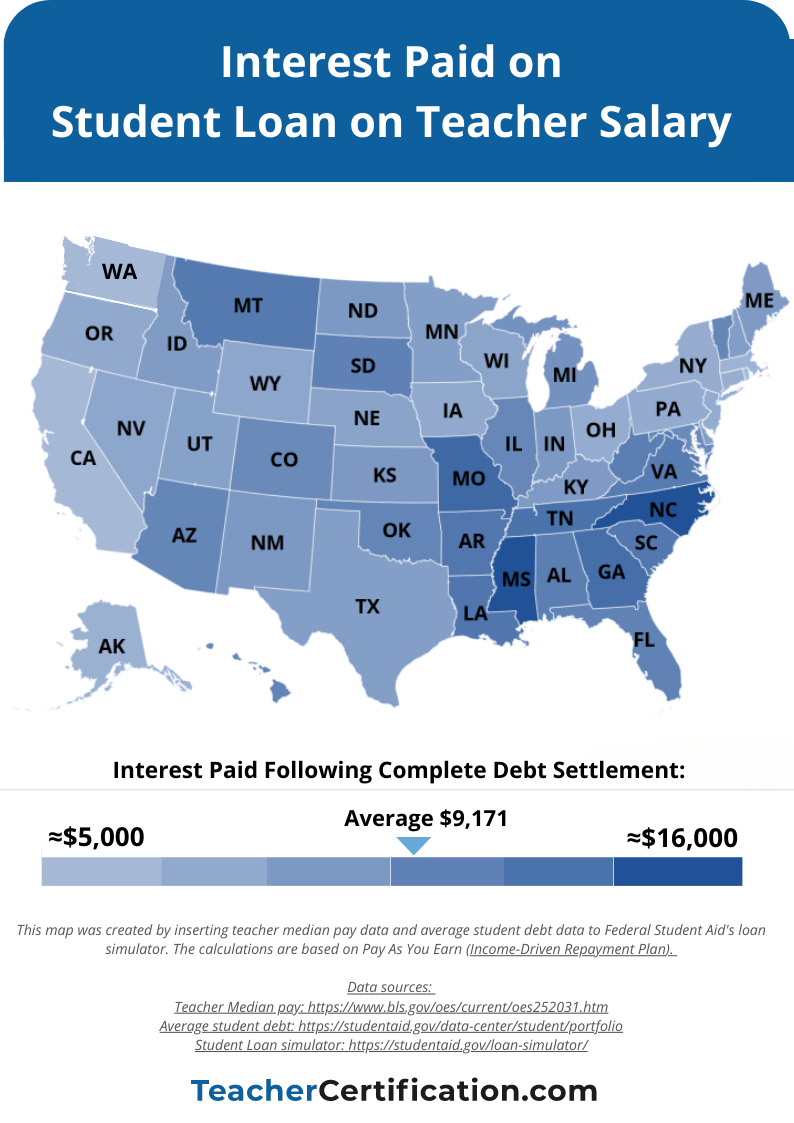

How interest rates impact student loans

A heatmap of the U.S. showing that teachers in D.C. have the highest interest payments in the U.S.

A clear trend emerges when it comes to student loan interest: The longer it takes to repay your loan, the more interest accrues. Notably, teachers in Washington, Rhode Island, and California experience the lowest interest payments, amounting to less than $5,300.

Interestingly, the District of Columbia –which boasts a decent median secondary teacher salary of $76,800 – faces the highest interest payments in the U.S. This can be attributed to the District of Columbia having the highest student debt per borrower in the country: an average debt of $54,870.

TeacherCertification.com

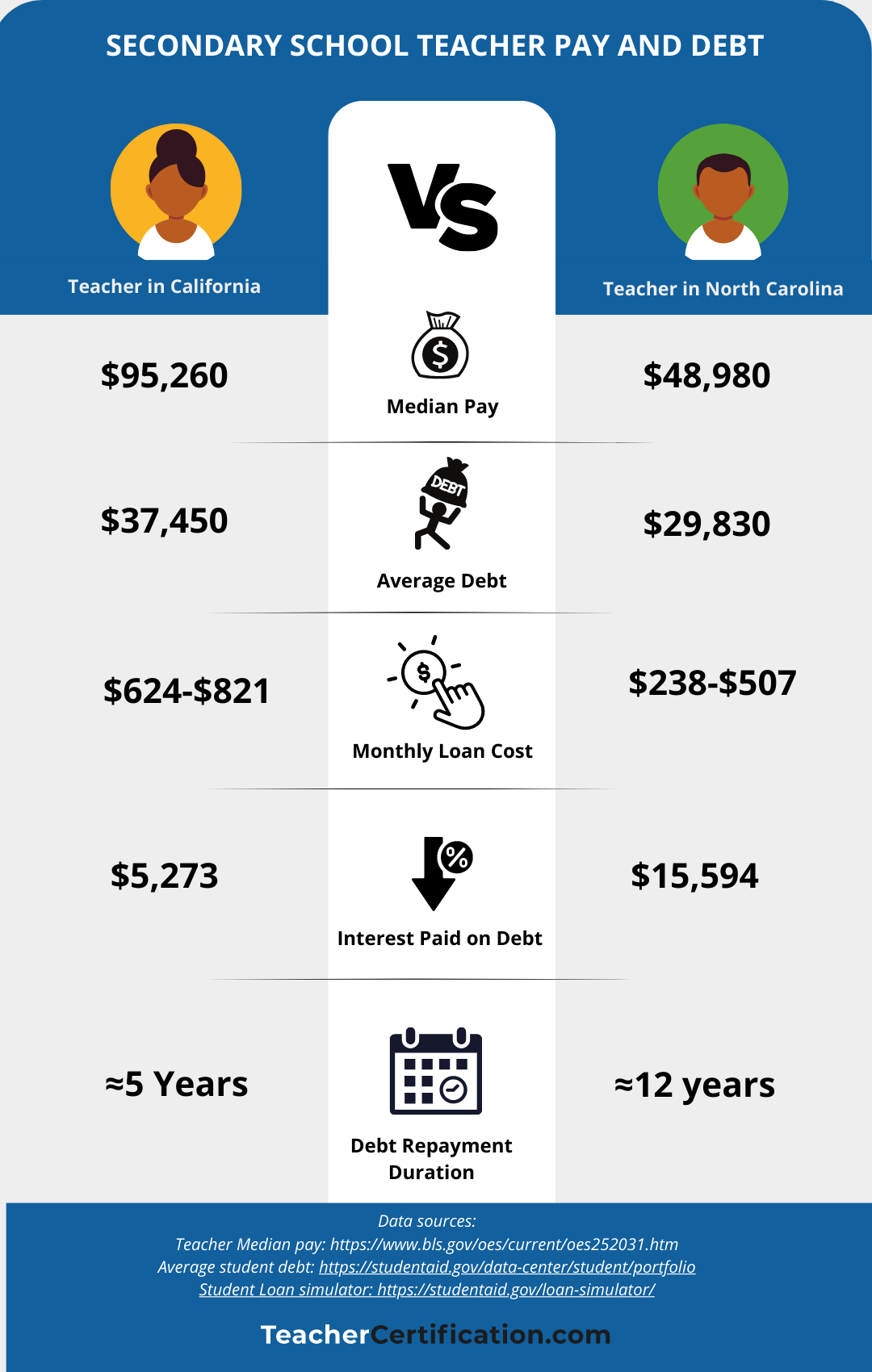

California versus North Carolina

Illustrated chart comparing secondary school teachers in California and North Carolina by student debt interests and loan costs.

Let’s compare two states that sit at opposite ends of the spectrum.

On the one hand, we have California, known for its fast loan payment rates and high median teacher salary. On the other hand, there’s North Carolina, where repayment rates tend to be slower and teacher pay lags behind.

The median California secondary school teacher makes $95,260, and the average student loan debt for all borrowers is $37,450. In this case, it would take around five years to pay back the student loan on a Californian teacher’s salary.

Conversely, in North Carolina, the student loan debt averages $29,830 and the median secondary school teacher makes $48,980. It would take more than 12 years to repay the loan on a Pay As You Earn Plan with this salary and level of debt. (Note that the Federal Student’s Aid Loan Simulator does not take into account state-specific tax rates and cost of living.)

This story was produced by TeacherCertification.com and reviewed and distributed by Stacker Media.