Buy vs. rent: A comparison of housing costs in U.S. cities

Canva

Buy vs. rent: A comparison of housing costs in U.S. cities

A family moving into a new home surrounded by boxes.

Potential homeowners may feel left in the dust with recent increases in costs and interest rates. But beyond the down payment, the right combination of factors in some U.S. cities leads to lower monthly mortgage costs than rental prices. This creates a favorable environment for starter homes, downsizing for retirement or even house hacking. On the other hand, homeownership goals don’t exactly make for the most financially secure path in other cities.

To help renters and potential homeowners identify opportunities where it costs less to buy a home than rent one – or where they’re better off renting – SmartAsset examined monthly mortgage and rental costs in nearly 600 cities nationwide.

Key Findings:

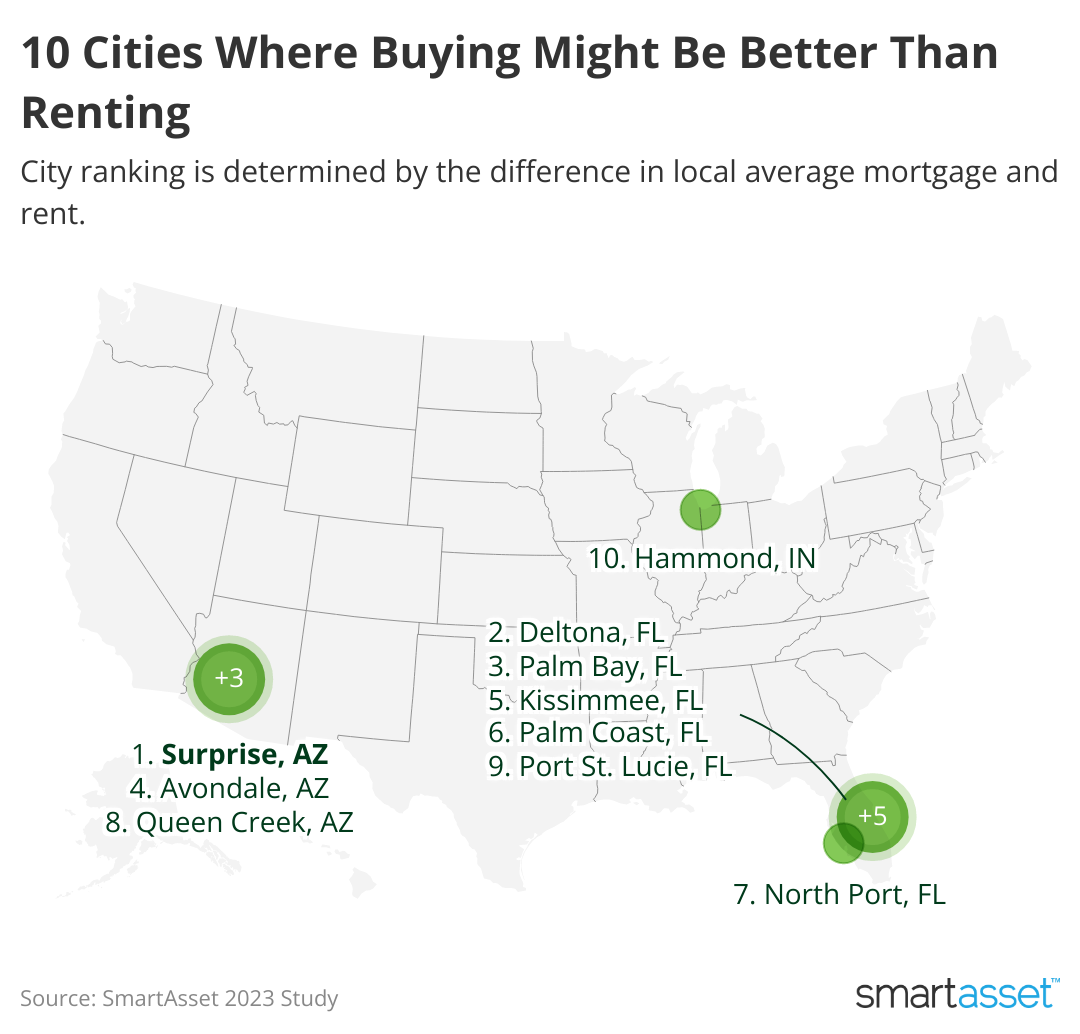

- Florida cities dominate the top 10 places where homes are cheapest to buy relative to renting. These cities include Deltona, Palm Bay, Kissimmee, Palm Coast, North Port and Port St. Lucie. However, there are outliers where a mortgage costs more than rent per month – like in Miami Beach, Miami, Fort Lauderdale and Boca Raton.

- Only six cities offer cheaper housing costs for homeowners than renters. Homeowners in two Arizona cities (Surprise and Avondale) and in four Florida cities (Deltona, Palm Bay, Kissimmee and Palm Coast) pay less on average for a mortgage than a monthly rent check.

- Homeownership costs twice as much as renting in some parts of California and New York. Monthly mortgage costs in Berkeley, Santa Monica, San Francisco and many others far outpace the cost of rent, costing as much as $2,000 more than rent. Meanwhile, cities in New York – including New Rochelle, New York City and Mount Vernon – also top the list of most expensive mortgages when compared to rent.

![]()

SmartAsset

Where It Makes More Sense to Buy

A map showing 10 U.S. cities where monthly mortgage costs are higher than monthly rents.

The top 10 cities where it makes most sense to buy than rent have the smallest differences between mortgage costs and rent. In most of these places, a monthly mortgage payment is actually cheaper than rent. As the data shows, the difference between mortgage and rental costs varies widely by city. A wide variety of factors influence housing markets.

1. Surprise, Arizona

Located just northwest of Phoenix and home to about 150,000 people, Surprise has the largest net difference between mortgage and rental costs. Rent here averages $192 more than a mortgage per month. Potential homeowners are looking at a median home value of $282,300.

2. Deltona, Florida

Deltona, located northeast of Orlando, has an average monthly mortgage cost of $1,187. Meanwhile, rent here costs $168 more – an average of $1,355. Consequently, homeownership is a popular option, with over 75% of homes owner-occupied. Residents have about a half hour drive to the coast.

3. Palm Bay, Florida

Palm Bay renters pay $130 more than their homeowner counterparts per month. The median value of a home is $186,100, with an average monthly mortgage of $1,174. Renters comparatively pay $1,304 per month. Over 120,000 people call Palm Bay home.

4. Avondale, Arizona

Monthly mortgages in Avondale cost $1,499, while rent costs $1,592. But only about 60% of residents take advantage of this $93 difference. The median home value is $252,400, upon which annual property taxes would cost $1,615.

5. Kissimmee, Florida

Kissimmee mortgages cost $1,281 per month, which is $80 less than rents, which average $1,361. This city of nearly 80,000 people is located on Lake Tokopekaliga, just south of Orlando. Only 45% of residents here are homeowners, leaving lots of opportunity for first-time homebuyers.

6. Palm Coast, Florida

The median home value in Palm Coast is $238,700. While the take-rate is relatively high for homeownership, this is the last of the cities where monthly mortgage costs are less than rental costs – albeit only by $34. Rents here cost $1,403 per month on average, while homeowners pay $1,369.

7. North Port, Florida

North Port is the city closest to rent and mortgage parity, meaning that the net difference between both costs is smallest out of all the cities considered. Even though it’s technically more expensive to own than rent here, the monthly mortgage cost of $1,293 is only $2 more than a monthly rental.

8. Queen Creek, Arizona

With under 70,000 residents, Queen Creek is the smallest city in the top 10 by population. But, it also has the highest median home value at $407,800. The average monthly mortgage payment is $2,054, while rent costs just $28 less ($2,026). Nearly 88% of homes are owner-occupied.

9. Port St. Lucie, Florida

Port St. Lucie is the largest city by population in the top 10, with more than 215,000 residents. Homeowners here pay $1,595 monthly for a mortgage, while renters pay $31 less. Property taxes on the average home value of $245,900 would be $3,221.

10. Hammond, Indiana

Hammond offers the lowest rent and mortgages in the top 10, so it is more affordable from a nominal standpoint. Monthly mortgage costs are $992, while rents are $959. Still, homeowner occupancy sits around 60%.

SmartAsset

Where It Makes Most Sense to Rent

A table listing 25 U.S. cities where average mortgage costs are lower than average rents.

On the other hand of the spectrum, buying into these markets may not offer the same opportunities. In fact, the average rents in these cities are generally less than half of mortgage costs.

- Berkeley, California

- Santa Monica, California

- San Francisco, California

- Newton, Massachusetts

- New Rochelle, New York

- Redmond, Washington

- Union City, New Jersey

- Yorba Linda, California

- Santa Barbara, California

- Elizabeth, New Jersey

Methodology

To find the net difference in mortgage and rent costs, we compared the following variables from the U.S. Bureau of Labor Statistics for 591 cities for which data was available. These included:

- Mortgage cost: Data comes from “Financial Characteristics of Housing Units With a Mortgage” based on the 2021 American Community Survey. This study examined median monthly housing costs for owner-occupied housing units with a mortgage.

- Rent cost: Data comes from “Selected Housing Characteristics” based on the 2021 American Community Survey, specifically the gross median rent for occupied units paying rent.

Median home value data also comes from data from the 2021 American Community Survey. Property tax data comes from SmartAsset’s property tax calculator.

Limitations

- This study did not account for down payments or one-time upfront costs of closing on a home. This may include real estate transfer taxes, appraisal fees, agent fees, title fees and lender charges.

- A select group of monthly mortgage payment costs were listed as $4,000+ in the raw data. These were assigned a value of $4,000 for the purposes of this study.

- While mortgages may be correlated with home prices, they are not directly tied to current median home values. Mortgages are a function of interest rates when they are issued, loan type, property taxes, credit ratings, home insurance, and other factors.

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.