Can you use a car loan to build credit?

Canva

Can you use a car loan to build credit?

A red and a white car in front of an auto dealership.

A bad credit score can make getting a car loan more difficult – and increase the cost of that loan in the long run. But as long as you are responsible about your loan, it can ultimately help you improve your credit score.

Automoblog has compiled information about credit scores and recommendations for how you can use an auto loan to help build or rebuild your score.

Auto Loans May Be an Opportunity For People With Bad Credit

One of the hardships for people with bad credit is the availability of credit itself. Lenders may be reluctant to offer credit to people with low scores. This results in a no-win situation wherein people need credit to improve their scores, but can’t get credit due to their scores. Specifically, most lenders will consider a FICO credit score under 580 to be a “bad” credit score.

Auto loans, however, can sometimes be one of the easier types of credit to obtain for people with low scores. Car loans are secured loans that use the vehicle as collateral, meaning a lender can repossess the car if the borrower fails to make payments. This means that lenders have more security with auto loans than they do with other forms of credit such as credit cards and personal loans.

Eric Ridley, an attorney who specializes in bankruptcy and credit issues, told Automoblog that car loans can help people build credit in some cases.

“An auto loan may be a good option for someone with bad credit and few other credit options, as it provides the opportunity to rebuild your score,” says Ridley. “But auto loans are a two-edged sword.”

![]()

Automoblog

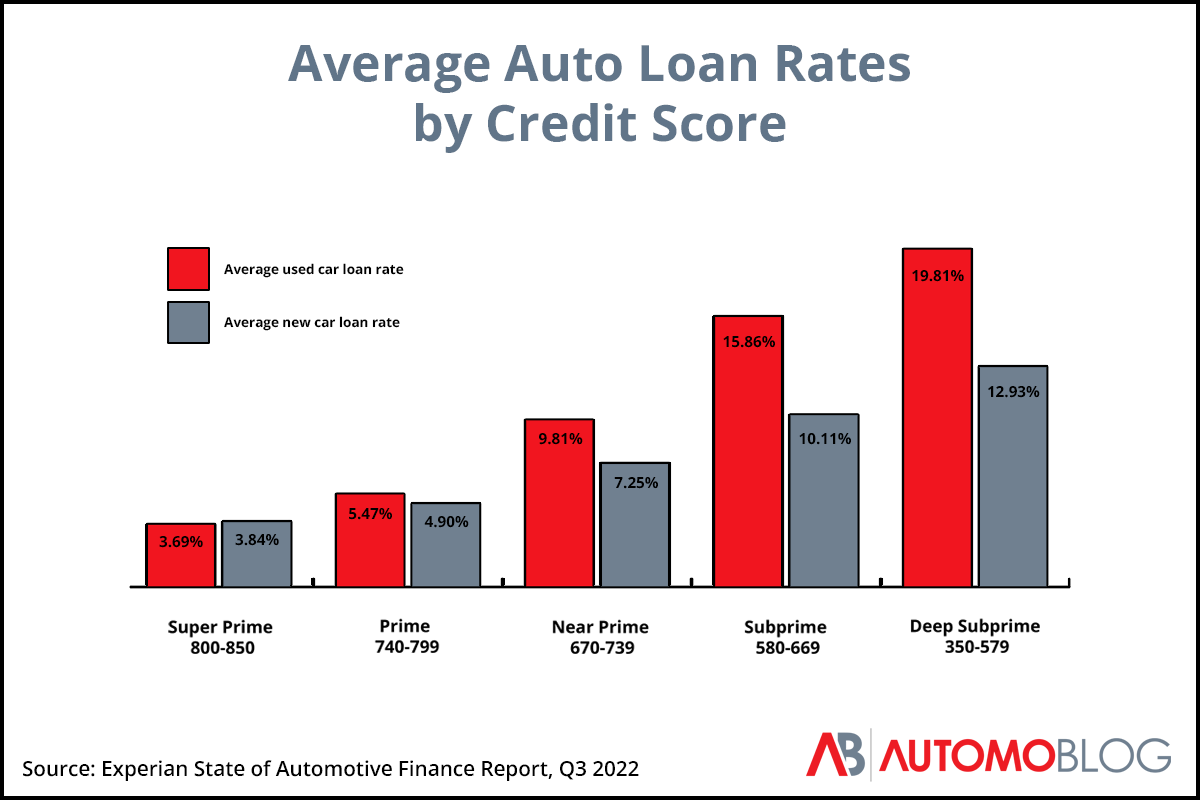

Bad Credit Car Loans Can Have Sky-High Interest Rates

A bar chart showing average auto loan interest rates generally increasing as credit scores decrease.

One of the biggest drawbacks with auto loans for people with bad credit is that they often come with high interest rates. In general, the lower your credit score, the higher your interest rate will likely be. Although legally the maximum interest rate for an auto loan is 16%, some lenders manipulate the details to charge annual percentage rates (APRs) as high as 25%.

“It’s not uncommon for lenders to charge extremely high interest rates to borrowers with poor or limited credit,” Ridley says. “This could cause not only the monthly payment, but the cost of the loan, to become unaffordable, and could result in pinched finances.”

Still, that doesn’t mean that you should rule out auto loans as a credit-building opportunity entirely, according to Ridley. He says that even high-interest rate auto loans can still be useful, but that borrowers should be sure they understand all the details of their loan before signing on.

“It’s critical to make sure you’re not ‘buying payments’ but that you understand and are comfortable with the terms of the loan, including the interest rate and any other associated costs, before entering into the agreement.”

Automoblog

Car Loans For People With Bad Credit Have Other Considerations

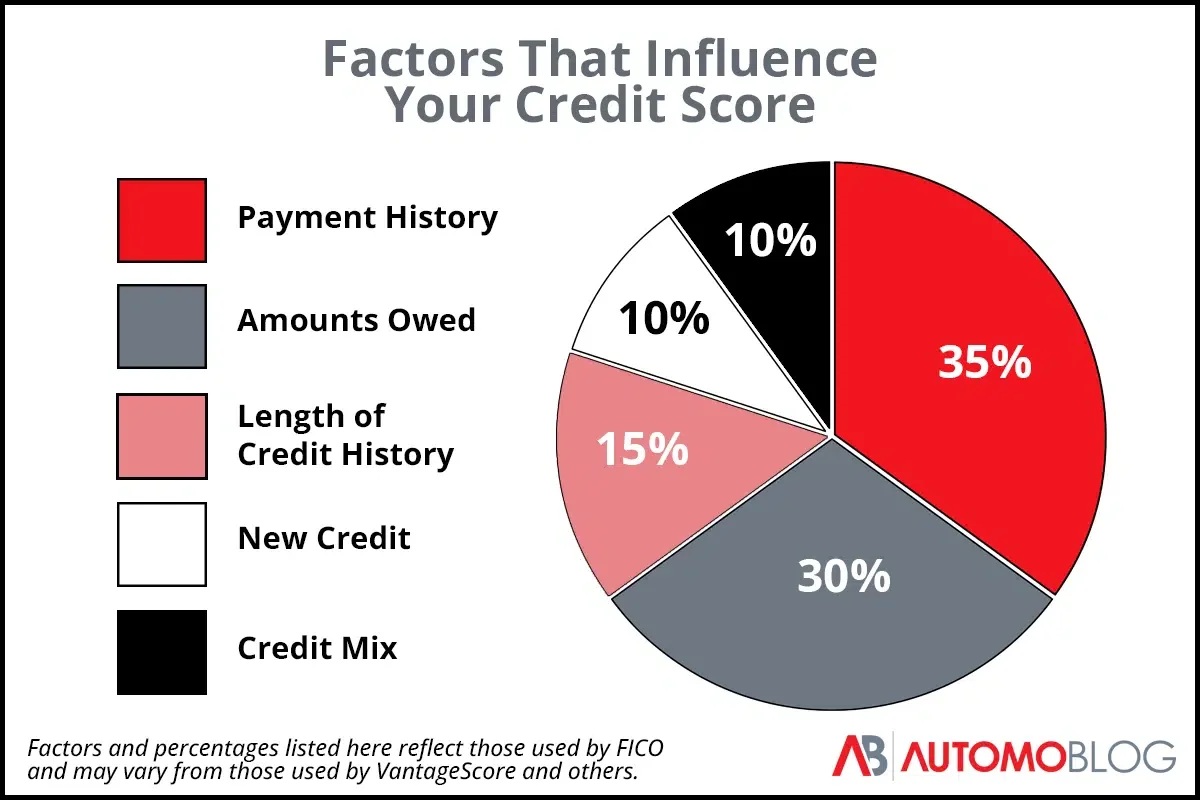

A pie chart showing that payment history has the most influence on credit score.

Borrowers have other factors to weigh beyond just the financial cost of a high-interest rate auto loan. For example, opening any line of credit usually has a temporary negative impact on a person’s credit score. That means borrowers should expect a dip in their score before they can build it back up with regular payments.

Ridley says that it’s also important to consider the effect a new loan will have on a borrower’s credit utilization ratio. This measures how much of a person’s available credit they’re currently using. While some types of credit increase a person’s available credit and therefore lower the ratio, that’s typically not the case with auto loans, Ridley says.

“If you take on a vehicle loan, you are immediately using 100% of the available credit on that credit line,” he says. “So, it’s important to get an auto loan in combination with other revolving credit, such as credit cards.”

Canva

How To Use a Bad Credit Car Loan To Build Credit

A credit score being displayed on a smartphone.

Building or rebuilding a credit score takes time and involves a few different factors. While an auto loan isn’t necessarily the single best tool for improving your score, it can be an integral part of a credit-building strategy.

Get Pre-Approved

Pre-approval is the process of getting a certified spending budget from a lender. To determine your budget, lenders check your credit history and other financial information. This is known as a “hard credit check.” Once you are pre-approved for an auto loan, a lender will issue you a pre-approval check that is good for any amount up to your limit. In other words, a pre-approval essentially guarantees a loan.

This is different from pre-qualification. While both processes give you an idea of your budget, pre-qualification is not a commitment from a lender. It uses self-reported information to give an estimated budget in what’s known as a “soft credit check.” Soft credit checks do not impact your credit score. That means pre-qualification is a good tool to help you learn what you can afford when you first start looking for a car.

Since the hard credit check required for a pre-approval can have a negative impact on your credit score, and a pre-approval is only valid for a limited time, you should wait to get pre-approved until you are in the position to make a purchase.

Stay Well Under Budget

It can be tempting to spend the maximum amount of money you’re approved for, but that’s typically not recommended. As long as the car you want to buy meets your lender’s requirements, you can spend as little as you want.

Borrowing less than you can afford leaves room in your budget for other things that may come up. Even if you don’t take on any new expenses, inflation can drive up the cost of living and leave you with less expendable income than you had when you agreed to your auto loan. This can make it difficult to meet payments.

Avoid “Buy Here, Pay Here” Dealerships

“Buy here, pay here” dealerships offer in-house financing options for car buyers. These can seem like a good option because they may approve some buyers that other lenders won’t. However, that tends to come at a cost, according to Ridley.

“These dealers sell used cars at high prices to desperate people and make a fortune on the high-interest loans they hold,” he says. “Some of them even want you to default so they can repossess the car and sell it again to someone else.”

Canva

Always Make Payments On Time

A line of cars in front of an auto dealership.

Your payment history is the single most influential factor in your credit history, accounting for 35% of your score. That means that making all of your required payments on time is essential to improving your credit score. A single missed payment could erase months of progress.

Some lenders may be willing to work with you if you get in touch before your payment due date and let them know you won’t be able to meet your obligations. They may be able to set up a partial payment or find other solutions.

However, not all lenders offer this, so it’s not an option you should depend on. This is a good reason to stay under your approved budget.

Pay More When Possible

Many lenders give you the option to pay more towards your principal – or the remaining loan balance – after you have met your monthly payment. Reducing your principal can decrease the amount you pay in interest, especially early in the loan term.

This also decreases your loan-to-value (LTV) ratio by lowering your debt while increasing the amount of equity you have in the car. A lower LTV ratio can, in turn, help improve your credit score.

Get Out From “Underwater” as Quickly as You Can

Owing more on your car than it’s worth is known as being “underwater” or “upside down” on a loan. This is a dangerous financial position to be in, but if you have to take on a bad credit car loan it may be impossible to avoid.

If you can afford to make extra payments, reducing the principal on your loan until it is less than the value of the vehicle is good practice. This can eventually get you out from underwater and allows you to start turning your debt into an asset.

Refinance Your Loan at the Right Time

Refinancing is the process of getting a new loan to pay off your existing loan. This can be an effective tool when the time is right to do so. If you’ve worked hard to improve your credit score, you may have access to lower interest rates than you did when you took on the original loan.

However, it’s not always a good time to refinance. Applying for a new loan will temporarily lower your score. It also comes with another round of fees that may exceed what you would save with a new loan rate.

Most experts recommend waiting to refinance until you’ve seen a significant improvement in your score or have greatly reduced your LTV ratio. Alternatively, you may want to consider refinancing if interest rates in general have gone down since you took on your original loan.

Canva

Use Other Credit-Building Tools

A person at home paying bills online.

As Ridley mentioned, there are several other tools that can help you build or rebuild your credit score. Some of these may even be preferable to auto loans for that purpose.

Some of the tools he recommends include:

- Secured credit cards: These credit cards function like “regular” credit cards but are backed by a deposit you make with the lender, usually in the range of $250 to $500. This deposit becomes your new credit limit.

- Credit builder loans: Some lenders offer small personal loans specifically designed to help people improve their credit.

- Authorized user status: You can “piggyback” on a trusted friend’s or relative’s credit by becoming an authorized user on one or more of their accounts. As long as this person meets their payments, you’ll start to see your credit improve. Most experts recommend avoiding having actual access to the credit card or other line of credit to prevent negatively impacting the account holder’s score.

- Rent reporting: Some companies can report rent payments to credit bureaus, which can help establish a good payment history if you always pay on time. Not all companies can or will do this, and you may have to ask for this service.

Auto Loans Can Help Build Credit If You’re Responsible

An auto loan isn’t a magic bullet for improving your credit, but it can be one of several tools you can use to work towards a higher score. As you work to improve your credit, keep in mind that many lenders now offer free credit reports to help you keep track of your score. If yours doesn’t, you can also get one free credit report from each of the three credit reporting agencies once per year.

Ultimately, a car loan can only help you build credit if you are responsible about it. At the bare minimum, you’ll need to make sure that you can commit to making monthly payments and to always doing so on time. While the process isn’t immediate, if you dependably meet your obligations and practice other good credit habits, you should start to see your score improve over time.

This story was produced by Automoblog and reviewed and distributed by Stacker Media.