What credit score do I need to buy a house?

Canva

What credit score do I need to buy a house?

A red brick home with a “For Sale” sign in the front yard.

The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. While it’s possible to get a mortgage with bad credit, you typically need good or exceptional credit to qualify for the best terms.

To help consumers better understand how credit scores affect homebuying, Experian compiled information on what credit score you’ll need to buy a house and how to improve your credit leading up to a mortgage application.

What credit score do I need to get a mortgage?

Several types of mortgage loans exist, and each one has its own minimum credit score requirement. Lenders may also have additional, stricter criteria they use to determine your creditworthiness other than your credit score (more on this below).

Here’s what to expect based on the type of loan you’re applying for:

Conventional loans minimum credit score: 620

Conventional loans typically require a minimum credit score of 620, though some may require a score of 660 or higher. These loans aren’t insured by a government agency and conform to certain standards set by the government-sponsored entities Fannie Mae and Freddie Mac. They’re by far the most commonly used mortgage loans.

Jumbo loans minimum credit score: 700

A type of nonconforming mortgage loan, jumbo loans may require a credit score of 700 or higher. These loans carry higher loan amounts than conventional loans.

FHA loans minimum credit score: 500

Insured by the Federal Housing Administration, FHA loans have a minimum credit score of 500 if you make a 10% down payment or 580 if you put down 3.5%.

VA loans minimum credit score: 620

There’s no minimum credit score set by the U.S. Department of Veterans Affairs, but lenders typically require a score of 620 or higher for VA loans. These loans were created for select members of the military community, their spouses and other eligible beneficiaries.

USDA loans minimum credit score: 580

Insured by the U.S. Department of Agriculture, USDA loans don’t have a minimum credit score set by the federal agency, but lenders typically require a score of at least 580. These loans are meant for low- and moderate-income homebuyers looking to purchase a home in rural areas.

If your credit score is in great shape, you may have several loan types from which to choose. But if your credit score is considered bad or fair, your options may be limited.

![]()

Experian

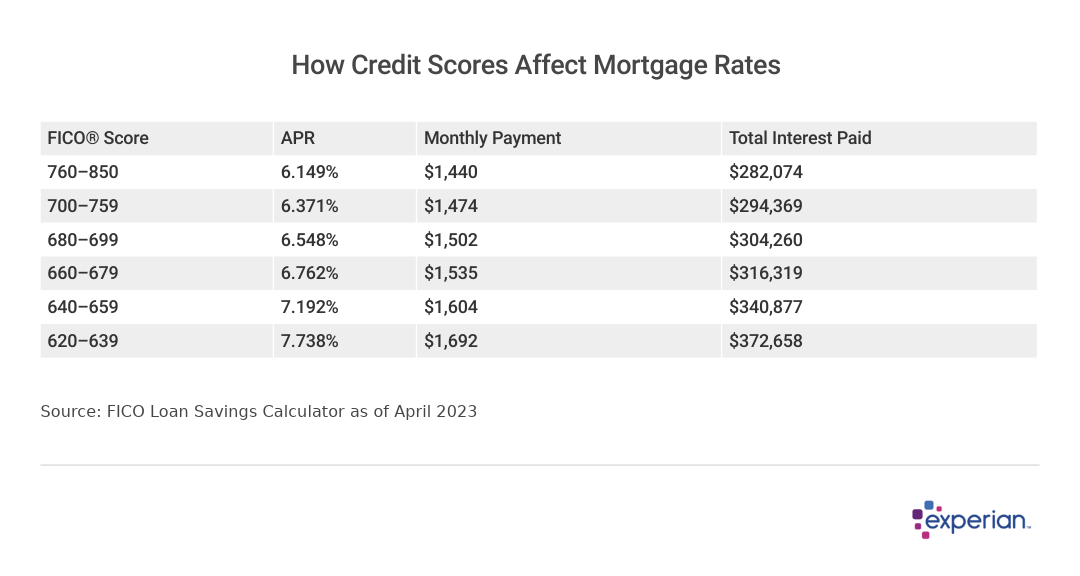

How your credit score affects mortgage rates

A data table showing the affect credit scores have on mortgage rates. The APR, monthly payment, and total interest paid are shown for a range of FICO credit scores, from 620 to 850.

Although homeowners with better credit scores have larger average mortgage balances, they tend to receive more favorable borrowing rates from lenders, resulting in lower interest payments over the life of the mortgage.

Your credit score plays a role in determining the interest rate and payment terms on a mortgage loan. That’s because lenders use what’s called a risk-based pricing model to determine loan terms.

The more likely you are to pay your bills on time, based on your credit history, the lower your interest rate may be. With a less-than-stellar credit score, however, you may end up paying more.

Credit score example

Let’s say you’re hoping to get a 30-year fixed-rate mortgage loan for the average mortgage balance of $236,443. If you have good credit (say, a 700 credit score) and qualify for a 6.371% interest rate, your monthly payment would be $1,474 (excluding property taxes, homeowners insurance and private mortgage insurance), and you’d pay a total of $294,369 in interest over the life of the loan.

But if your credit needs some work and you qualify for a 7.738% interest rate instead, that increases your monthly payment to $1,692 and your total interest burden to $372,658—a difference of $78,289.

Other factors lenders consider

Mortgage lenders don’t just look at your credit score when determining your rate, though. They’ll also consider your debt-to-income ratio (DTI)—how much of your gross monthly income goes toward debt payments—as well as your down payment and available savings and investments.

So while it’s important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation.

Images Products // Shutterstock

Can you get a mortgage with a bad credit score?

A millennial man searching information online, working with computer laptop.

It’s possible to get approved for a mortgage with poor credit. But just because you can, it doesn’t necessarily mean you should. As previously discussed, even a small increase in your interest rate can cost you tens of thousands of dollars over the length of a mortgage loan.

If you’re planning on buying a home and you have bad credit, here are a few tips that can help you potentially score a decent interest rate:

- Think about applying for an FHA loan.

- Make a large down payment to reduce the risk to the lender.

- Get preapproved with multiple lenders.

- Consider working with a mortgage broker who may be able to match you with a specialized loan program.

- Pay down large credit card balances to reduce your credit utilization rate.

- Work on paying down other debts to reduce your DTI.

- Consider asking someone with good or exceptional credit to apply with you as a cosigner.

There’s no guarantee that these actions will help you qualify for a mortgage loan with good terms, but they can improve your odds.

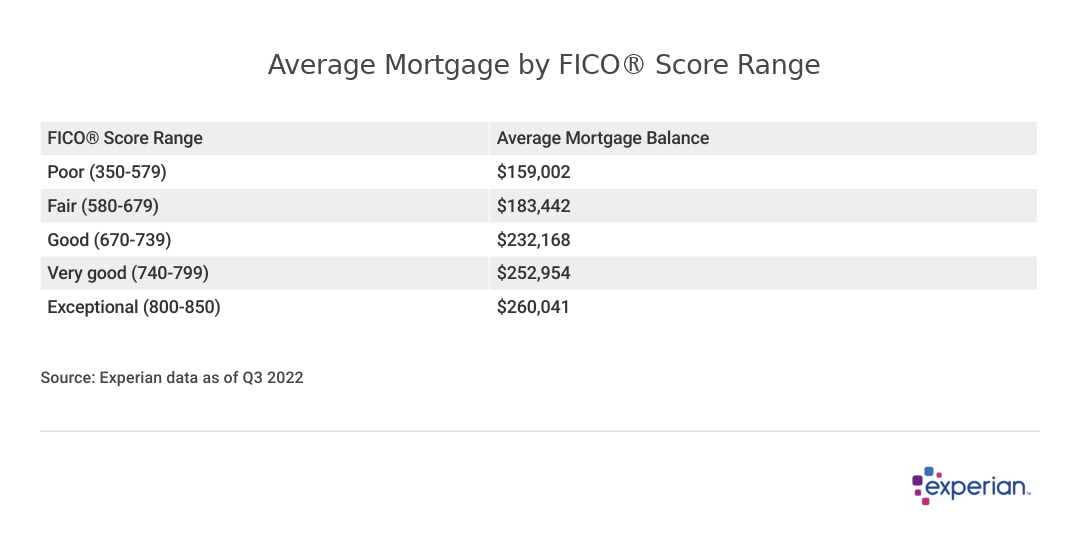

Experian

How to prepare your credit for a mortgage

A data table showing the average mortgage by FICO score range, which goes from 350 to 850. The average mortgage balance ranges from $159,002 and $260,041.

If you’re thinking about buying a home soon, it may be worth spending some time getting your credit ready before you officially begin the process. Here are actions you can start taking now, some of which can improve your credit score relatively quickly.

1. Check your credit score and reports

Knowing where you stand is the first step to preparing your credit for a mortgage loan. You can check your credit score with the three national credit reporting agencies, and if it’s already in the 700s or higher, you may not need to make many changes before you apply for a preapproval.

But if your credit score is low enough that you risk getting approved with unfavorable terms or denied altogether, you’ll be better off waiting until you can make some improvements.

You can get a free copy of your credit report from each of the three national credit reporting agencies weekly at AnnualCreditReport.com through December 2023, then every 12 months after that.

Once you have your reports, read through them and watch for items you don’t recognize or you believe to be inaccurate. If you find any inaccuracies, you can ask your lender to update their information with the credit reporting agencies. You also have the right to dispute the items directly with the agencies. This process can improve your score quickly if it results in a negative item being removed.

2. Pay down debt

Paying off other debts can not only lower your debt-to-income ratio but also help improve your credit score. That’s especially the case if you have credit card debt.

Your credit utilization rate—how much credit card debt you have in relation to your total available credit—is an important factor in your credit score. While many credit experts recommend having a credit utilization of 30% or less, there is no hard-and-fast rule—the lower, the better.

Because your credit utilization rate is calculated each month when your credit card balances get reported to the credit bureaus, your credit score could respond quickly if you pay down high credit card balances.

3. Avoid applying for new credit

Virtually every time you apply for credit, the lender runs a hard inquiry on your credit report. In most cases, you’ll see your credit score drop by fewer than five points with one inquiry, if at all.

But if you have multiple inquiries in a short period, it could have a compounding effect and lower your credit score even more. (One exception is when you apply for several of the same type of loans, such as a mortgage or car loan, as a way to compare offers. If you do so in a short time period, all the inquiries will be grouped into one, limiting the impact on your credit score.)

Also keep in mind that adding new credit can increase your DTI, which is a crucial factor for mortgage lenders.

4. Consider waiting

If your credit report includes some significant negative items, such as a bankruptcy, collection account or repossession, it may take more time for your credit score to recover than from high credit card balances or one late payment. In this case, it may be a good idea to wait until you can build a more positive credit history before applying for a large loan.

Waiting could also be worthwhile when the housing market is hot, or if interest rates are on the rise. Depending on how much flexibility you have, you may benefit from waiting until the market cools off, giving buyers more leverage than sellers, or until interest rates start to decline again.

Think about more than just the loan terms

A mortgage is a long-term financial commitment. But getting into a home with less-than-perfect terms now can still make sense in certain situations.

If you live in an area where a mortgage payment would be cheaper than what you pay in rent, for example, even a loan with a slightly higher interest rate could save you money in the short term. And if owning your own home improves your overall quality of life, that could be worth paying a little more.

This story was produced by Experian and reviewed and distributed by Stacker Media.