Here are the states with the most expensive college tuitions—and what to know about paying for them

Canva

Here are the states with the most expensive college tuitions—and what to know about paying for them

Exterior view of an ornate, red brick college building against a blue sky.

According to National Center for Education Statistics, 16 million individuals attend post-secondary institutions in the United States each year. Over the years, the average cost of college has risen dramatically. While there are several different post-secondary educational pathways that students can take, the one most commonly discussed is a four-year bachelor’s degree from an accredited college.

The cost of college varies significantly based on several factors, including the type of institution (public, private non-profit, or private for-profit) and especially the location. Some states have a much higher average college tuition per year than others.

Students who attend public colleges in their home state also tend to pay much lower tuition than out-of-state students. Because tuition costs are so high, some students elect to complete part or all of their degrees at community colleges, which tend to be much more affordable, but community colleges do lack prestige and have limited courses.

All of these factors come together to make up a simple truth: college in the United States is extremely expensive, and costs have grown in recent years. Study.com compiled data from the National Center of Education Statistics and other sources to find which states have the most affordable and lowest tuitions—and why.

![]()

Study.com

Why is college so expensive?

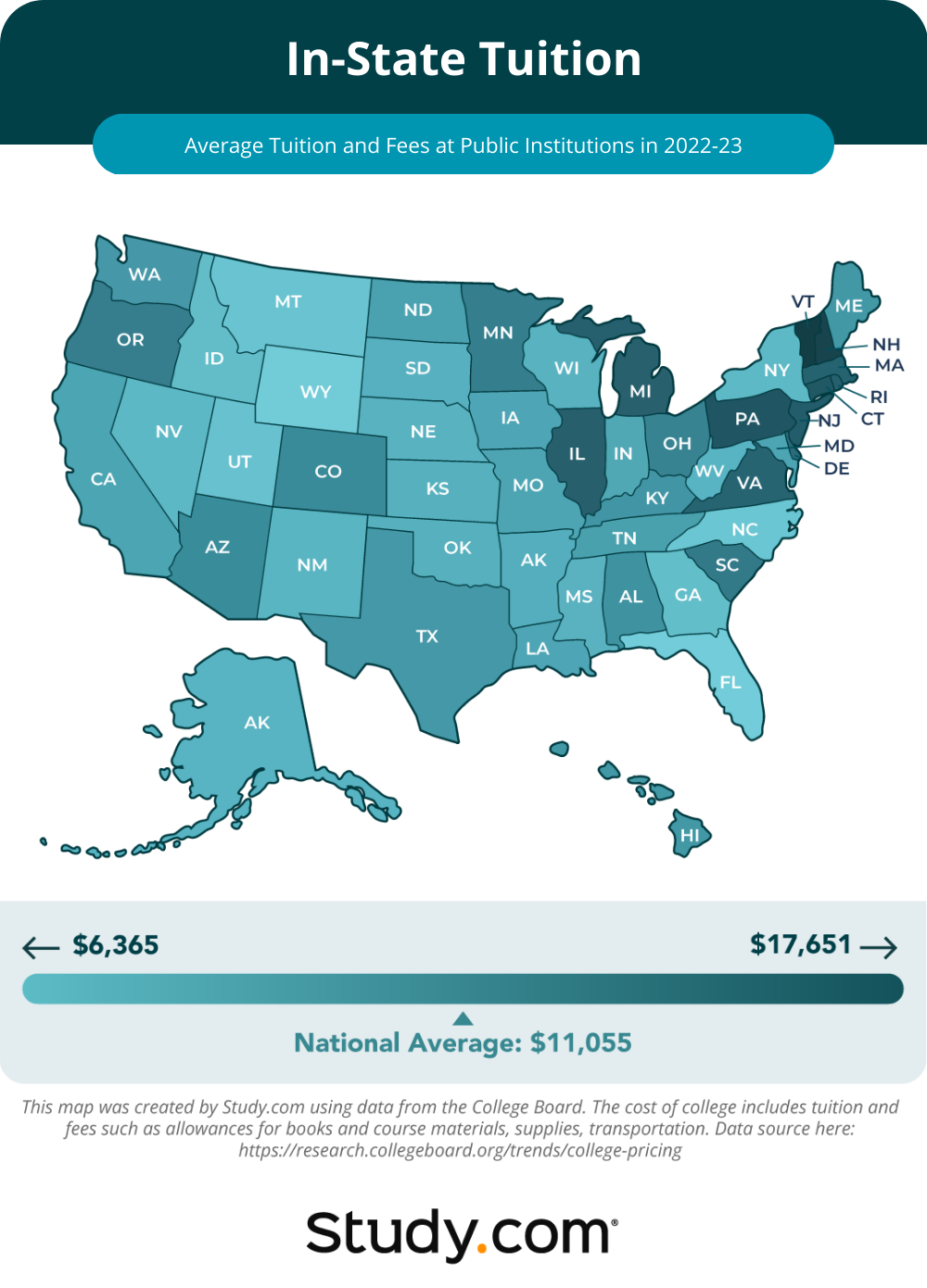

A heat map showing the average in-state tuition and fees at public institutions across the U.S. during the 2022-23 academic year.

Many students wonder why college is so expensive and why costs have risen sharply. College tuitions in the US are among some of most expensive in the world.

Another reason is that many U.S. states are spending less on public colleges than before, meaning that more of the burden of cost falls on students and their families. The rising costs can be partially attributed to inflation, a further reduction in state funding, and stagnating wages across the country.

The program that students choose to attend can also be the reason for varied costs. There is also a difference between college tuition, which is the cost of the actual instruction; the costs of living in a campus dorm; and college fees, which covers everything else students will need for their college experiences. All of these factors come together and result in the final total cost of college.

Attending a public college means the school receives state funding and likely has lower tuition. Attending college as an in-state student can also mean avoiding higher tuition of a private school. If a program is not offered in a student’s home state, it is sometimes possible to get a college to waive out-of-state fees to allow students to attend.

Tuition rates shown on college sites are usually per year rather than the total amount for a four-year degree, so students should always do the math to see how much they will be paying in total.

Although college is very expensive, is still widely considered a beneficial investment. A college degree can make it much easier for young adults to find professional connections and broaden their knowledge base, which can help them enter well-paid career tracks. When making this investment, there are a lot of things students can do to reduce costs.

Canva

College expenses

Students listen as a professor speaks in a college lecture hall.

The total price tag on a college degree is called the cost of attendance (COA). This cost includes tuition, fees, room and board, textbooks and supplies, transportation to and from campus, and any other personal expenses that students might incur throughout their degree program.

The cost of tuition is usually split into either semesters or quarters, depending on how the school schedule is laid out. Fees can cover any support services and facilities offered by the college, including funding for student organizations, sports teams, events, amenities, and more.

College tuition and fees range for many reasons, and it is always worth looking at a COA breakdown if one is available to see where money is going. Some colleges allow students to opt-out of some fees if they are not planning on taking part in the services offered, ultimately reducing the total cost of schooling.

Average college tuition per year

The cost of college changes each year, usually increasing in most states. According to the National Center for Education Statistics (NCES), the cost of college tuition rose by approximately 10% at public colleges, 19% at private non-profit colleges, and 1% at private for-profit colleges between 2010 and 2020. It is estimated that this rate of increase will continue; it may even accelerate for all of the reasons listed above.

Just as tuition costs are increasing, so is the average student debt. Approximately 43.8 million people in the US currently have federal student debt, Over the past decade, there has been a 45% increase in inflation-adjusted debt, while repayment rates have drastically declined.

Private loans (as opposed to government loans) tend to be particularly aggressive in their interest rates and can be challenging to pay off. Because of these high costs, some students start their degrees at community colleges and then transfer later. While that can be a great plan, it is always important for students to check the credit transfer policies in their state to avoid problems.

Study.com

Tuition rate by state

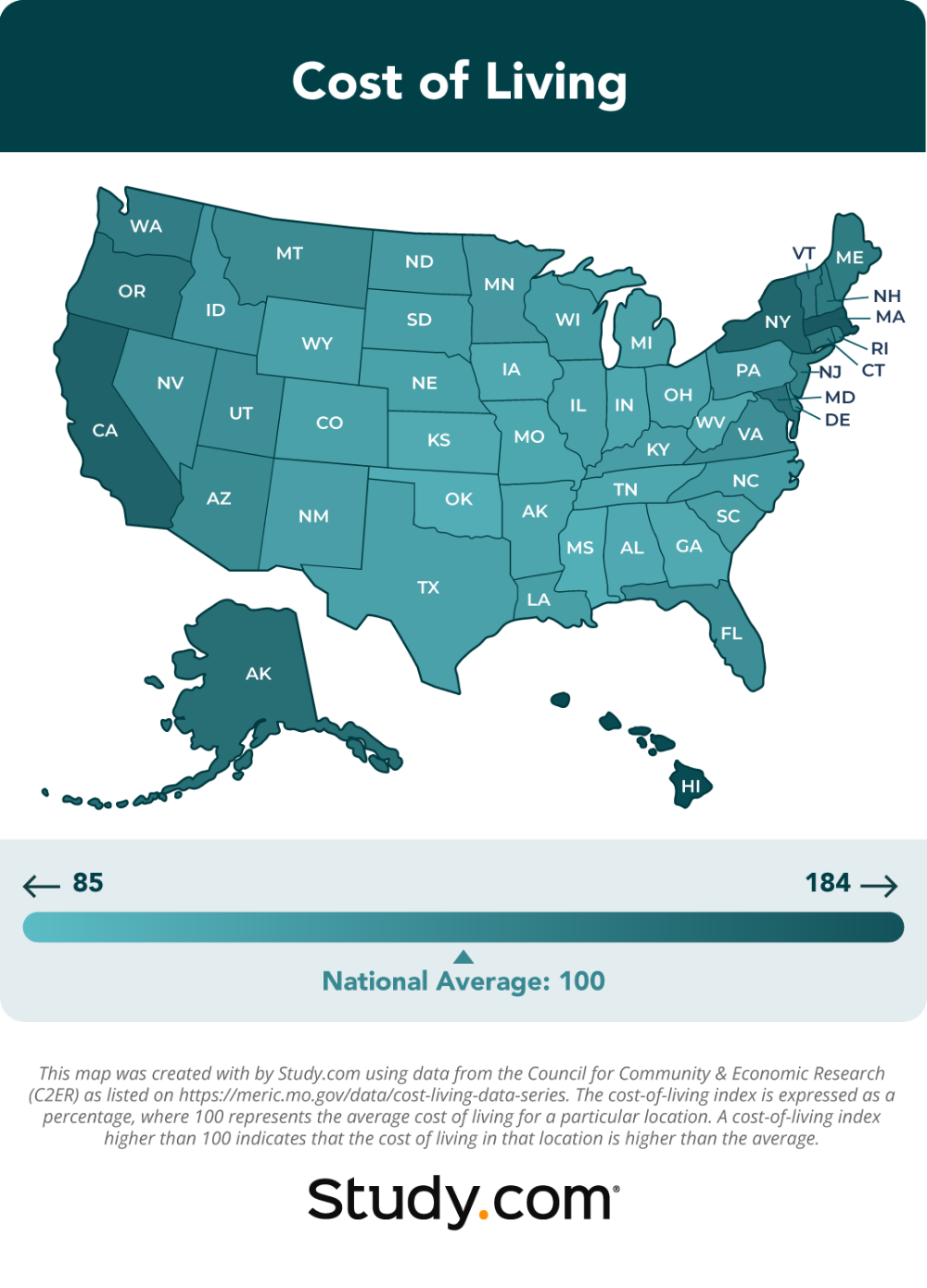

A heat map of the U.S. showing the cost of living in each state.

One of the biggest factors that influence the cost of college is the state where the college is located.

Other factors that influence the cost of college in each state include how much funding each state provides to its schools, the number of colleges available, and how many students each campus accepts.

Tuition costs vary by state, with the median in-state tuition for public four-year college being $11,055 per year when you adjust the cost to inflation. Note that cost of living does not necessarily correlate with college costs. Mississippi is the cheapest state to live in, but its average tuition is $9,100 per year, for example. Florida has the cheapest tuition and fees, at $6,370 per year, but falls about a third of the way on the list for cost of living.

On the other end, Hawaii is the most expensive state to live in by quite a wide margin, but it falls just over the halfway mark for tuition, at $11,000 per year.

Vermont costs an average of $17,650 per year in tuition but is eleventh from the top of the cost of living chart.

While there is a general trend of tuition rising with the cost of living, there are several exceptions. For some, attending an in-state public college may be the best option, but others might want to leave their state for somewhere with a lower cost of living, even if out-of-state tuition will be more expensive.

Study.com

How much does 4 years of college cost on average?

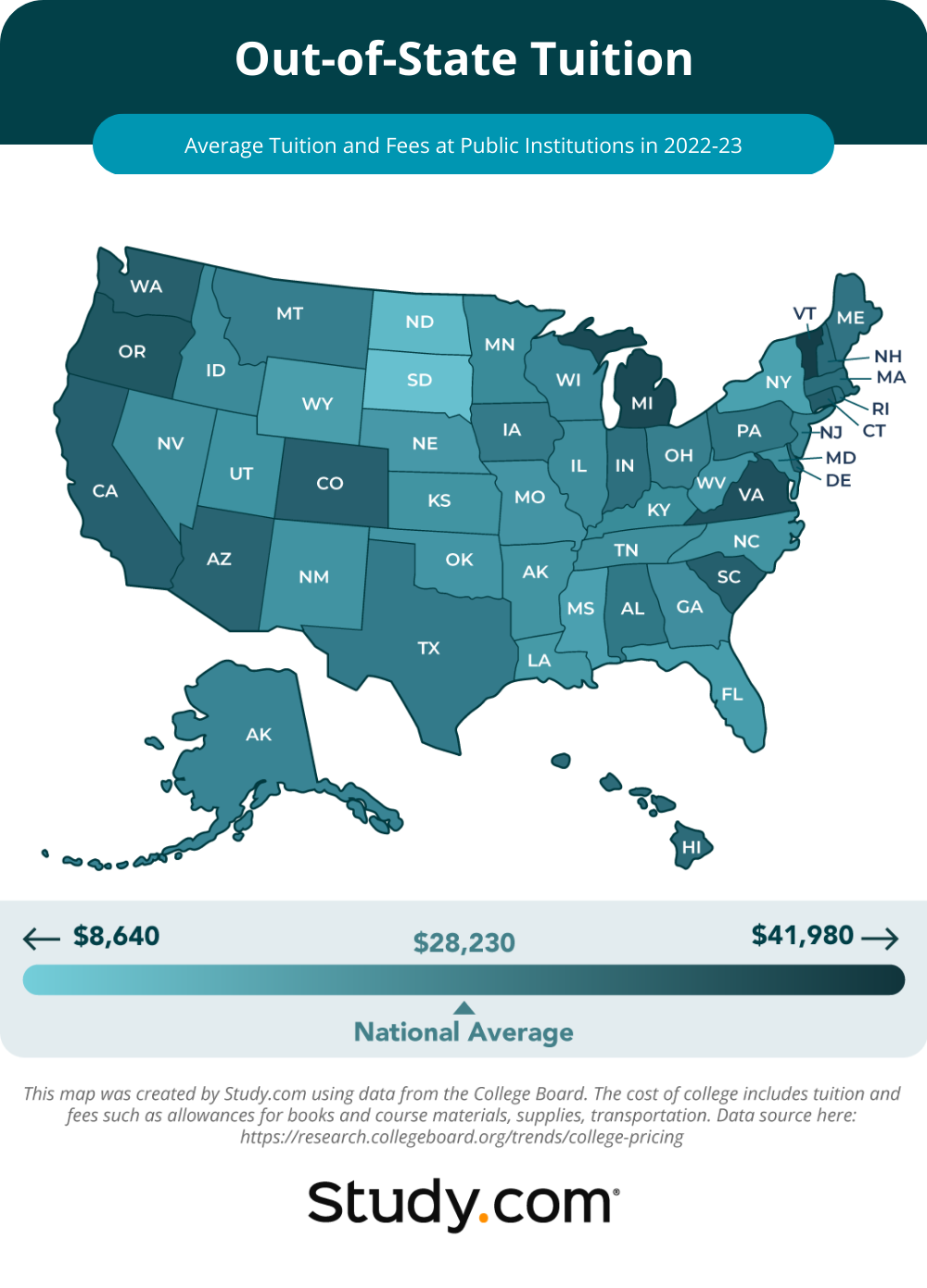

A heat map showing the average out-of-state tuition and fees at public institutions across the U.S. during the 2022-23 academic year.

It would be nice if there was just one number covering the average cost of college in each state. Unfortunately, because there are several types of colleges and several payment structures, there are multiple numbers to compare. State averages for in-state tuition differ from out-of-state tuition, and what about private colleges, and community colleges?

While some college options are cheaper than others, tuition is rising across the board, and some students have to choose between not attending college or taking on large amounts of debt. Before getting into the public-vs-private debate, consider the tuition costs for one of the more overlooked options: community college. Some students attend community college to boost credits, and others complete a full two-year associate’s degree at these schools.

According to a recent College Board Report on College Tuition Trends, the average tuition and fees at public two-year institutions have increased from $2,340 to $3,860, while at public four-year institutions, they have increased from $4,870 to $10,940 in the last 30 years. The average tuition and fees at private nonprofit four-year institutions also increased during this time frame from $21,860 to $39,400.

Average cost of public college

Typically, public schools are often the most cost-effective option. According to the report by the College Board, the nationwide average cost of public college for in-state students was $10,940 in 2022-2023 school year, $190 higher than in 2021-2022. For out-of-state students, that number rises to $28,240.

There are good reasons for studying out of state: Some programs are only offered at certain colleges, some students want a particular campus experience, and some students travel to take part in various sports. Visiting schools and asking questions is a good way to learn more about the best fit.

Vermont is the most expensive for out-of-state students, averaging $41,980 per year. The cheapest location for out-of-state students was South Dakota, at just $12,830 per year. These figures are for four-year institutions; while two-year institutions do have out-of-state costs, the difference tends to be much smaller.

Cost of private college

The cost of private college is calculated differently from public institutions. There is no distinction between in-state and out-of-state costs for these schools.

Private colleges get less public funding and generally charge higher tuition rates. However, there are some relatively inexpensive private colleges, so students should not write them off entirely without extensive research.

Many private colleges also offer generous scholarships to help students pay for tuition. Most private colleges offer room and board, so those costs will be included in the following figures even though the sticker price for tuition might be lower.

Students should always research any school they choose to attend to ensure they receive a high-quality degree from a properly accredited institution. As of the 2022-2023 school year, the College Board reported that private non-profit colleges cost an average of $39,400 per year. For comparison, the tuition for for-profit institutions, which generally are aimed for students living at home, was on average $15,710 in 2021-2022.

While these are the average costs, some private colleges are significantly more expensive. The total cost of attending the University of Chicago is around $86,856 per year, according to the U.S. Department of Education. Other top price tags include Brown University ($83,686), the University of Pennsylvania ($85,738), and Dartmouth College ($83,802).

Canva

How to pay for college

Two students intently study the screen of a laptop together.

Looking at all of these statistics about the cost of college can make many students balk. The good news is that there are many good ways to pay for college that do not have to involve going into debt. Careful organization and research can yield positive results.

This is not to say that college is within reach of everyone because that would ignore the lived realities of many people who face financial and family barriers. However, the high price tag on colleges does not have to be the sole prohibitive factor for students who do not currently have the funds for their education.

Families can start saving money for college in a tax-advantaged 529 college savings plan. Some people also pay for part or all of their college tuition by getting a job while in school, although the days when it was possible to pay one’s way through college with part-time work are long over.

Some jobs do have tuition benefits, including work-study programs and on-campus jobs. For those who do choose to work during college, attending night classes or doing online school or remote work may be easier options to manage.

As previously noted, attending community college and transferring those credits to a four-year institution can make payment easier, especially since two-year institutions still have scholarships and financial aid available. In some cases, getting transfer credits can also help students graduate early, ultimately saving money.

Canva

Sources of funding for college

Two male students study a laptop together in their dorm room.

Getting a job and saving money are two good options, but there are many other sources of funding for college, and most students source their tuition in a variety of ways.

Scholarships are offered by colleges and by independent institutions, often providing thousands of dollars to successful applicants. Grants are similar to scholarships but are usually provided only to families that have financial need.

Scholarships and grants are excellent options because they do not have to be repaid. Students should fill out a Free Application for Federal Student Aid (FAFSA) to be matched with various funding options from grants to scholarships to loans. There are also various online databases for scholarship searches that help match students from all backgrounds with the best funding sources for their needs.

Student loans are a common option for many students wishing to finance a college degree, but they have their downsides. Loans must be repaid with interest, meaning that many students end up carrying significant debt just as they start their careers.

Some loans have a grace period after graduation, after which students begin payments, while others are more aggressive. Because of the financial burden that loans pose down the line, it is always important to research the exact terms of any loan and to have a repayment plan in place to ensure that the full amount can be paid off as soon as possible.

Applying to funding

The process of applying for scholarships can be lengthy, so students should start as early as possible and be organized in their approach to each application. This is also true of FAFSA applications.

Some grants and scholarships are available year-round, but most have set application deadlines and have limited funding, so only those whose applications are completed in good time are considered. Students who receive merit-based scholarships usually have to maintain a certain GPA throughout their college careers to maintain funding.

When applying for any source of funding, students should be sure to read all instructions carefully and present a clear, professional, and complete application.

For each application, all elements (resumes, essays, and so on) must be unique and tailored to best show off a student’s good qualities. Resumes, if required, should cover work experience, education, soft skills, hard skills, and other valuable experiences like volunteering and relevant extracurriculars.

Canva

Student debt

Four students walk away from the camera down an ornate corridor of a historic college.

As previously mentioned, more than 43 million people in the U.S. currently have student debt. That debt totals around $1.75 trillion dollars as of 2022. Over 90% of the student debt is owned by the federal government, while the rest is held in private loans.

Private loan companies do not publicly release information, but currently, the average federal loan debt per borrower is https://educationdata.org/student-loan-debt-statistics. It is estimated that, including private loans, the average may be as high as $39,590 per person. For those who attend public colleges, the average amount borrowed is $31,410 over four years.

In recent years, there have been increasing calls to forgive student debt, and there are some indications that this loan forgiveness may be on the horizon for some borrowers. However, nobody should take out loans on the assumption that they will be forgiven. With college costs continuing to increase, many people feel that going into debt is their only option. Although college can be a worthy investment, it is always a good idea to minimize future debt and exhaust all other sources of funding before considering private loans.

Is college worth it?

There is no way around it: Attending college in the United States is expensive.

Although costs can seem overwhelming, not every college costs $79,000 per year: Many are significantly cheaper, and it is always worth looking at the breakdown of costs to find more affordable options.

Attending a public college as an in-state student, transferring from a community college, and applying for scholarships and grants are all good ways to make college a less financially daunting experience.

This story originally appeared on Study.com and has been independently reviewed to meet journalistic standards.