Which states rely the most on motorist taxes to pay for road repairs?

Sergii_Petruk // Shutterstock

Which states rely the most on motorist taxes to pay for road repairs?

Road workers repairing a srteet with new hot asphalt

Who hasn’t driven down a bumpy, pothole-filled road and wondered where their taxpayer dollars are going? In 2018 alone, highway and road repairs across the U.S. totaled a whopping $145.33 billion—but that hasn’t been enough to keep up with the nation’s ailing transportation infrastructure. It’s estimated that 1 in 5 miles of highways and major roads—along with 45,000 bridges—are in poorly maintained condition. States usually charge motorist taxes to pay for the construction and maintenance of these roads.

To determine which states depended the most on taxes for roadway maintenance projects, Jerry compiled data from local and state government finance sources, the Federal Highway Administration, and the Tax Foundation, an independent, nonprofit tax policy institute that uses figures from the U.S. Census Bureau. States that have more highway repairs needed than they have tax income to fund often turn to other additional taxes to make up the difference.

Variables like inflation and the popularity of electric cars are throwing a wrench into states’ highway funding plans. In addition, newer cars, which were once reliable sources of revenue in the past, now have better fuel economy, decreasing the amount of fuel-related taxes that states can collect. Looking ahead, many federal and state legislators are exploring a vehicle miles traveled tax, according to the Tax Foundation. This alternative approach is based on the number of miles a motor vehicle user travels instead of how much they spend on fuel. Though it would bring in more revenue, it also raises alarm bells regarding taxpayers’ privacy.

The four states that managed to raise 100% for their road-related costs through charges and tolls, licensing fees, and motor fuel taxes are California, Tennessee, Montana, and Indiana. Not surprisingly, California’s expenditures dwarf the others, with the Golden State spending $12 billion on roadway maintenance. Tennessee and Indiana spent about $1.6 billion for their shares of highway expenditures and Montana came in at less than $500 million.

Among all four states, the largest amount of taxpayer money came in the form of motor fuel tax revenues. Indiana sourced 78% of its infrastructure revenue from gas taxes, with Tennessee (67%), Montana (57%), and California (53%) following behind. The other funding sources include licensing revenue and tolls.

On the other side of the spectrum are the states where taxpayer money accounted for only a small share of their highway spending. These include Alaska, where only 17% of highway spending was sourced from state infrastructure revenue, and North Dakota, where it was only 29%. To make up for their shortfall, both of these states turn to revenue from severance taxes, which are levied when natural resources like oil and natural gas are extracted from the state.

When it comes to size, Wyoming taxpayers, who live in the least populated state, contributed 58%, or $409 million, to their state infrastructure expenses. By comparison, the two most populous states after California are New York and Texas. New Yorkers contributed 60%, or $13 billion, to the total cost of maintaining their roadway while Texans kicked in 74%, or $11 billion. All of these states must turn to other sources for funding, such as revenue collected from other levies or the federal government.

Below are the state infrastructure revenue and highway spending numbers for every state and Washington, D.C. Using 2018 figures from a Tax Foundation study, the following data does not include contributions to the individual states and Washington D.C. from the federal government, only those portions for which the states themselves are responsible. Those states that raised more than 100% of their highway- and road-related costs were ranked according to the percentage that exceeded the full portion raised. Any ties in the rankings are the result of rounding the figures.

![]()

f11photo // Shutterstock

#51. Washington D.C.

Highways outside of Washington D.C.

– District’s highway spending in 2018: $433.2 Million

– District infrastructure tax revenues: $66.5 Million

– Amount of district’s highway spending funded by motorist taxes: 15%

Jay Juno // Shutterstock

#50. Alaska

Downtown traffic in Anchorage, Alaska

– State’s highway spending in 2018: $1.05 Billion

– State infrastructure tax revenues: $180.8 Million

– Amount of state’s highway spending funded by motorist taxes: 17%

Guy William // Shutterstock

#49. North Dakota

A road in Fargo, North Dakota

– State’s highway spending in 2018: $1.15 Billion

– State infrastructure tax revenues: $335.8 Million

– Amount of state’s highway spending funded by motorist taxes: 29%

SNEHIT PHOTO // Shutterstock

#48. Vermont

Highway 89 in Vermont during autumn

– State’s highway spending in 2018: $452.6 Million

– State infrastructure tax revenues: $158.2 Million

– Amount of state’s highway spending funded by motorist taxes: 35%

TLF Images // Shutterstock

#47. Utah

A scenic road in Utah

– State’s highway spending in 2018: $1.67 Billion

– State infrastructure tax revenues: $736.7 Million

– Amount of state’s highway spending funded by motorist taxes: 44%

Kristi Blokhin // Shutterstock

#46. Arkansas

A highway in Little Rock, Arkansas

– State’s highway spending in 2018: $1.48 Billion

– State infrastructure tax revenues: $665.8 Million

– Amount of state’s highway spending funded by motorist taxes: 45%

Canva

#45. Wisconsin

A road in Wisconsin

– State’s highway spending in 2018: $3.94 Billion

– State infrastructure tax revenues: $1.78 Billion

– Amount of state’s highway spending funded by motorist taxes: 45%

barbsimages // Shutterstock

#44. Connecticut

Heavy traffic on an interstate highway in Stamford, Connecticut

– State’s highway spending in 2018: $1.62 Billion

– State infrastructure tax revenues: $734.9 Million

– Amount of state’s highway spending funded by motorist taxes: 45%

nsiliya // Shutterstock

#43. Rhode Island

A highway in Pawtucket, Rhode Island, during early morning

– State’s highway spending in 2018: $316.4 Million

– State infrastructure tax revenues: $147.3 Million

– Amount of state’s highway spending funded by motorist taxes: 47%

Sandra Foyt // Shutterstock

#42. Nebraska

Interstate 80 as seen from the overlook at the Great Platte River Road Archway Monument Museum in Kearney, Nebraska

– State’s highway spending in 2018: $1.32 Billion

– State infrastructure tax revenues: $618.3 Million

– Amount of state’s highway spending funded by motorist taxes: 47%

Mark Herreid // Shutterstock

#41. Minnesota

Downtown Minneapolis, Minnesota, skyline and interstate highway 35W

– State’s highway spending in 2018: $4.15 Billion

– State infrastructure tax revenues: $1.96 Billion

– Amount of state’s highway spending funded by motorist taxes: 47%

Paul Brady Photography // Shutterstock

#40. South Dakota

Pigtail Bridge along the Needles Highway in the Black Hills of South Dakota

– State’s highway spending in 2018: $666.3 Million

– State infrastructure tax revenues: $315.5 Million

– Amount of state’s highway spending funded by motorist taxes: 47%

SunflowerMomma // Shutterstock

#39. Alabama

Highway leading into downtown Mobile, Alabama

– State’s highway spending in 2018: $2.10 Billion

– State infrastructure tax revenues: $1.01 Billion

– Amount of state’s highway spending funded by motorist taxes: 48%

TFoxFoto // Shutterstock

#38. Nevada

A road running through the Valley of Fire State Park near Las Vegas, Nevada

– State’s highway spending in 2018: $1.72 Billion

– State infrastructure tax revenues: $836.0 Million

– Amount of state’s highway spending funded by motorist taxes: 49%

Krasula // Shutterstock

#37. Mississippi

Cars in a traffic jam

– State’s highway spending in 2018: $1.23 Billion

– State infrastructure tax revenues: $623.3 Million

– Amount of state’s highway spending funded by motorist taxes: 51%

Trong Nguyen // Shutterstock

#36. Louisiana

An aerial view Highway 90 in the suburbs of New Orleans, Louisiana

– State’s highway spending in 2018: $1.40 Billion

– State infrastructure tax revenues: $768.6 Million

– Amount of state’s highway spending funded by motorist taxes: 55%

FTiare // Shutterstock

#35. Iowa

I-80 highway in Iowa

– State’s highway spending in 2018: $2.41 Billion

– State infrastructure tax revenues: $1.36 Billion

– Amount of state’s highway spending funded by motorist taxes: 56%

haveseen // Shutterstock

#34. Wyoming

The road fleading rom Yellowstone National Park to Grand Teton National Park in Wyoming

– State’s highway spending in 2018: $409.8 Million

– State infrastructure tax revenues: $238.3 Million

– Amount of state’s highway spending funded by motorist taxes: 58%

Tim Roberts Photography // Shutterstock

#33. Arizona

Loop 101 and I-17 interchange in Phoenix, Arizona

– State’s highway spending in 2018: $1.90 Billion

– State infrastructure tax revenues: $1.12 Billion

– Amount of state’s highway spending funded by motorist taxes: 59%

Sean Pavone // Shutterstock

#32. New York

The FDR highway leading into numerous Manhattan skyscrapers in New York City

– State’s highway spending in 2018: $13.03 Billion

– State infrastructure tax revenues: $7.84 Billion

– Amount of state’s highway spending funded by motorist taxes: 60%

LisaCarter // Shutterstock

#31. Virginia

Interstate 77/81 in southwest Virgina

– State’s highway spending in 2018: $4.48 Billion

– State infrastructure tax revenues: $2.76 Billion

– Amount of state’s highway spending funded by motorist taxes: 61%

Alexey Stiop // Shutterstock

#30. Kentucky

Richmond Road in Lexington, Kentucky

– State’s highway spending in 2018: $1.57 Billion

– State infrastructure tax revenues: $994.1 Million

– Amount of state’s highway spending funded by motorist taxes: 63%

Vicki L. Miller // Shutterstock

#29. Colorado

Traffic going towards the Rocky Mountains in Denver, Colorado

– State’s highway spending in 2018: $2.77 Billion

– State infrastructure tax revenues: $1.78 Billion

– Amount of state’s highway spending funded by motorist taxes: 64%

JSvideos // Shutterstock

#28. North Carolina

Cars driving over Linn Cove Viaduct, Blue Ridge Parkway in North Carolina

– State’s highway spending in 2018: $4.64 Billion

– State infrastructure tax revenues: $2.99 Billion

– Amount of state’s highway spending funded by motorist taxes: 65%

inarts // Shutterstock

#27. Maine

A bike cyclist riding downhill along Cadillac Mountain Road in Acadia National Park, Maine

– State’s highway spending in 2018: $785.5 Million

– State infrastructure tax revenues: $513.0 Million

– Amount of state’s highway spending funded by motorist taxes: 65%

amadeustx // Shutterstock

#26. Kansas

A state highway in Kansas

– State’s highway spending in 2018: $1.30 Billion

– State infrastructure tax revenues: $852.3 Million

– Amount of state’s highway spending funded by motorist taxes: 66%

Christian Hinkle // Shutterstock

#25. Pennsylvania

Lush farmland roads flowing around Raystown Lake, in Pennsylvania

– State’s highway spending in 2018: $9.08 Billion

– State infrastructure tax revenues: $6.00 Billion

– Amount of state’s highway spending funded by motorist taxes: 66%

Medard L Lefevre // Shutterstock

#24. West Virginia

Traffic in downtown Charleston, West Virginia

– State’s highway spending in 2018: $846.4 Million

– State infrastructure tax revenues: $559.9 Million

– Amount of state’s highway spending funded by motorist taxes: 66%

Real Window Creative // Shutterstock

#23. Missouri

Cars and trucks driving in and out of te downtown city center of Kansas City, Missouri

– State’s highway spending in 2018: $1.56 Billion

– State infrastructure tax revenues: $1.06 Billion

– Amount of state’s highway spending funded by motorist taxes: 68%

Brian Kapp // Shutterstock

#22. Ohio

The Indiana/Ohio border where cars enter Ohio while traveling east on Interstate 70

– State’s highway spending in 2018: $4.61 Billion

– State infrastructure tax revenues: $3.16 Billion

– Amount of state’s highway spending funded by motorist taxes: 69%

Wangkun Jia // Shutterstock

#21. New Hampshire

Downtown Portsmouth, New Hampshire

– State’s highway spending in 2018: $586.8 Million

– State infrastructure tax revenues: $419.1 Million

– Amount of state’s highway spending funded by motorist taxes: 71%

FiledIMAGE // Shutterstock

#20. Illinois

The intersection of highway 290 and highway 90 in downtown Chicago

– State’s highway spending in 2018: $6.35 Billion

– State infrastructure tax revenues: $4.59 Billion

– Amount of state’s highway spending funded by motorist taxes: 72%

Kristi Blokhin // Shutterstock

#19. South Carolina

A highway road in South Carolina

– State’s highway spending in 2018: $1.64 Billion

– State infrastructure tax revenues: $1.21 Billion

– Amount of state’s highway spending funded by motorist taxes: 74%

Regan Bender // Shutterstock

#18. Texas

Complex highway system in San Antonio, Texas

– State’s highway spending in 2018: $11.54 Billion

– State infrastructure tax revenues: $8.59 Billion

– Amount of state’s highway spending funded by motorist taxes: 74%

Brett Barnhill // Shutterstock

#17. Georgia

Atlanta highway traffic

– State’s highway spending in 2018: $3.04 Billion

– State infrastructure tax revenues: $2.29 Billion

– Amount of state’s highway spending funded by motorist taxes: 75%

Suraju Kehinde // Shutterstock

#16. Maryland

A highway leading into Baltimore, Maryland

– State’s highway spending in 2018: $3.07 Billion

– State infrastructure tax revenues: $2.35 Billion

– Amount of state’s highway spending funded by motorist taxes: 76%

Gordon Montgomery // Shutterstock

#15. Oregon

Oregon Coast Highway near Cannon Beach, Oregon

– State’s highway spending in 2018: $1.58 Billion

– State infrastructure tax revenues: $1.23 Billion

– Amount of state’s highway spending funded by motorist taxes: 78%

O.Malikoff // Shutterstock

#14. Florida

A highway leading into Miami

– State’s highway spending in 2018: $9.15 Billion

– State infrastructure tax revenues: $7.26 Billion

– Amount of state’s highway spending funded by motorist taxes: 79%

View Apart // Shutterstock

#13. Massachusetts

Methuen Street at Appleton Street in Lawrence, Massachusetts

– State’s highway spending in 2018: $2.82 Billion

– State infrastructure tax revenues: $2.24 Billion

– Amount of state’s highway spending funded by motorist taxes: 79%

Melanie Hobson // Shutterstock

#12. New Mexico

A scenic road in New Mexico

– State’s highway spending in 2018: $572.0 Million

– State infrastructure tax revenues: $460.4 Million

– Amount of state’s highway spending funded by motorist taxes: 80%

Real Window Creative // Shutterstock

#11. Michigan

Interstate highway traffic flowing around Detroit, Michigan

– State’s highway spending in 2018: $3.56 Billion

– State infrastructure tax revenues: $2.91 Billion

– Amount of state’s highway spending funded by motorist taxes: 82%

Nick Fox // Shutterstock

#10. Oklahoma

Pony Bridge on Route 66 in Oklahoma

– State’s highway spending in 2018: $1.93 Billion

– State infrastructure tax revenues: $1.59 Billion

– Amount of state’s highway spending funded by motorist taxes: 82%

Inbound Horizons // Shutterstock

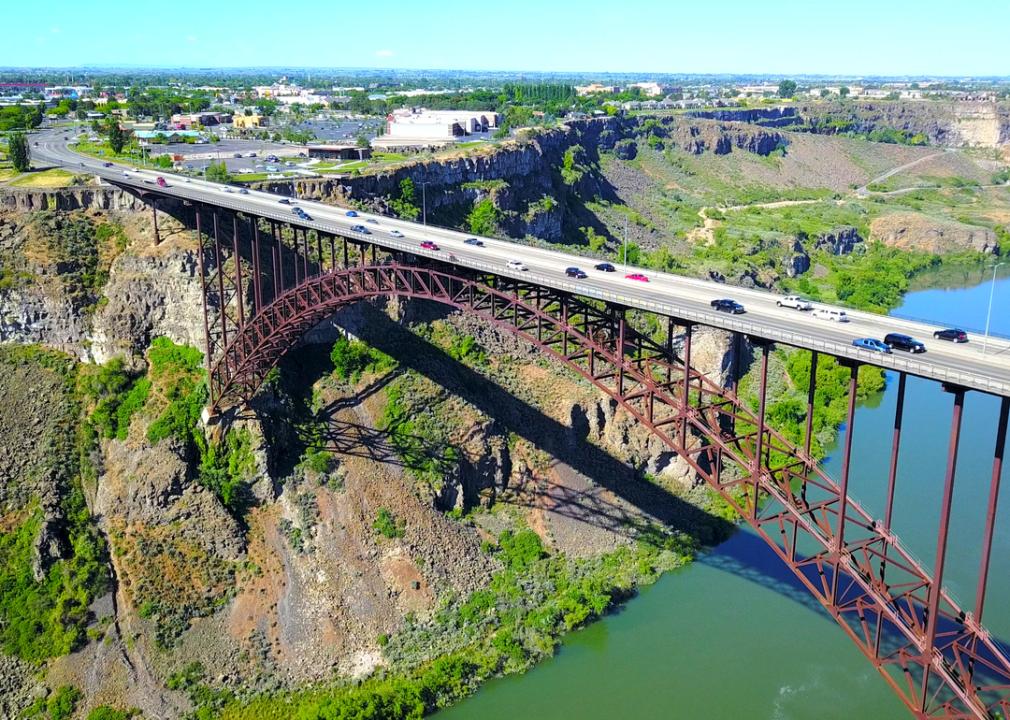

#9. Idaho

Perrine Bridge in Twin Falls, Idaho

– State’s highway spending in 2018: $735.0 Million

– State infrastructure tax revenues: $611.8 Million

– Amount of state’s highway spending funded by motorist taxes: 83%

Nadia Borisevich // Shutterstock

#8. Hawaii

A road in Maui

– State’s highway spending in 2018: $700.2 Million

– State infrastructure tax revenues: $588.6 Million

– Amount of state’s highway spending funded by motorist taxes: 84%

FotosForTheFuture // Shutterstock

#7. New Jersey

Donald Goodkind Bridge crossing over Raritan River in New Jersey

– State’s highway spending in 2018: $3.98 Billion

– State infrastructure tax revenues: $3.38 Billion

– Amount of state’s highway spending funded by motorist taxes: 85%

Khairil Azhar Junos // Shutterstock

#6. Delaware

Highway signs on Interstate 95 in Wilmington, Delaware

– State’s highway spending in 2018: $583.6 Million

– State infrastructure tax revenues: $515.0 Million

– Amount of state’s highway spending funded by motorist taxes: 88%

Checubus // Shutterstock

#5. Washington

Seattle interstate freeways

– State’s highway spending in 2018: $3.72 Billion

– State infrastructure tax revenues: $3.53 Billion

– Amount of state’s highway spending funded by motorist taxes: 95%

Mark Schwettmann // Shutterstock

#4. California

San Francisco’s Rincon Hill with the western approach to the Bay Bridge in the foreground

– State’s highway spending in 2018: $12.03 Billion

– State infrastructure tax revenues: $11.99 Billion

– Amount of state’s highway spending funded by motorist taxes: 100%

Valerie Ann Ayres // Shutterstock

#3. Tennessee

A road winding through Tennessee

– State’s highway spending in 2018: $1.60 Billion

– State infrastructure tax revenues: $1.61 Billion

– Amount of state’s highway spending funded by motorist taxes: 100%

Michael Gordon // Shutterstock

#2. Montana

Traffic in the downtown area of Helena, Montana

– State’s highway spending in 2018: $433.6 Million

– State infrastructure tax revenues: $446.7 Million

– Amount of state’s highway spending funded by motorist taxes: 100%

Shadowspeeder // Shutterstock

#1. Indiana

Traffic near a mall in Greenwood, Indiana

– State’s highway spending in 2018: $1.61 Billion

– State infrastructure tax revenues: $1.81 Billion

– Amount of state’s highway spending funded by motorist taxes: 100%

This story originally appeared on Jerry and was produced and

distributed in partnership with Stacker Studio.