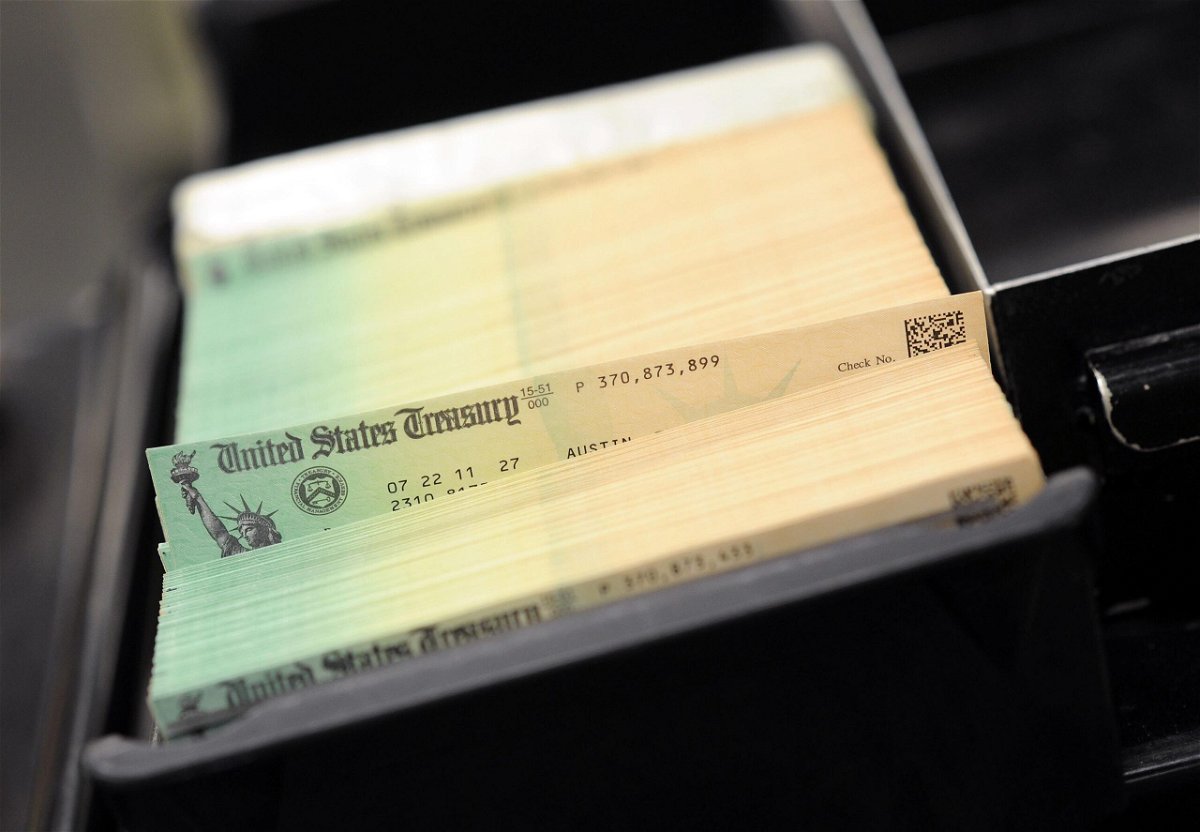

Nearly 50 million seniors could face Social Security payment delays if debt ceiling isn’t raised

Nearly 50 million seniors could face Social Security payment delays if the debt ceiling isn't raised.

By Tami Luhby, CNN

Nearly 50 million senior citizens could face delays in their Social Security payments if Congress does not suspend or raise the debt ceiling in the coming weeks, Treasury Secretary Janet Yellen told lawmakers Thursday.

“It would be catastrophic for the economy and for individual families,” Yellen said at a House Financial Services Committee hearing.

“Nearly 50 million seniors could stop receiving Social Security payments or receive them delayed,” Yellen said, echoing what she wrote in a Wall Street Journal op-ed earlier this month. “Our troops would not know when they would get their next paycheck. We have 30 million families who rely on the monthly child tax credits and they would not receive that relief, at least not on time.”

RELATED: Debt ceiling: What to know as Congress nears an October 18 deadline

Unless Congress addresses the debt limit by October 18, the federal government will no longer be able to borrow to pay for its operations, forcing it to limit its spending. Although the House has twice passed measures to do so, the effort is expected to fail again in the Senate, where Republicans are united in their opposition to the bill.

Just what it would mean for Americans remains uncertain since Congress has always stepped in to raise, extend or revise the definition of the debt limit in the past. The Treasury Department could still pay some of its bills since it would still have tax revenue coming in, but it’s not known what it would decide to pay and when, experts said.

Social Security beneficiaries would be at risk for not receiving their payments for the first time since the program was created in 1935, said Max Richtman, CEO of the National Committee to Preserve Social Security and Medicare. They are scheduled to receive $90 billion in payments in October.

RELATED: These government benefits would be at risk if Congress doesn’t raise the debt ceiling

Some 40% of beneficiaries depend on the monthly checks for at least 90% of their income, and two-thirds of recipients depend on the infusions for at least half of their income, he said.

“Not having a check for a few weeks or a month is devastating,” Richtman said. “Beneficiaries are going to have to decide: Do I pay my rent? Do I buy food? Do I buy my medicine?”

Also, millions of parents who are set to receive three more monthly installments of the enhanced child tax credit this year may also have to wait for the funds if there is a default.

RELATED: Some parents are missing the September child tax credit payment

The Internal Revenue Service is scheduled to send approximately $15 billion in payments on the 15th of each month, and many families are depending on the money to buy food and necessary items for their children. Parents receive up to $300 for each child up to age 6 and up to $250 for each one ages 6 to 17.

Meanwhile, more than 42.3 million Americans who receive food stamps could be left waiting for their monthly benefits — an average of $227 per person.

A default and extended impasse could also have major implications for the national economy, with federal spending cuts potentially triggering a downturn comparable to the Great Recession, according to Moody’s Analytics. Nearly 6 million jobs could be lost, stock prices could drop by one-third and about $15 trillion in household wealth could evaporate.

A 2011 showdown, which was ultimately resolved late in the game, spooked the stock market, raised borrowing costs and eroded consumer confidence.

The-CNN-Wire

™ & © 2021 Cable News Network, Inc., a WarnerMedia Company. All rights reserved.

CNN’s Matt Egan contributed to this report.