BlackRock cares about money, not ‘woke’ politics

Every year

By Julia Horowitz, CNN Business

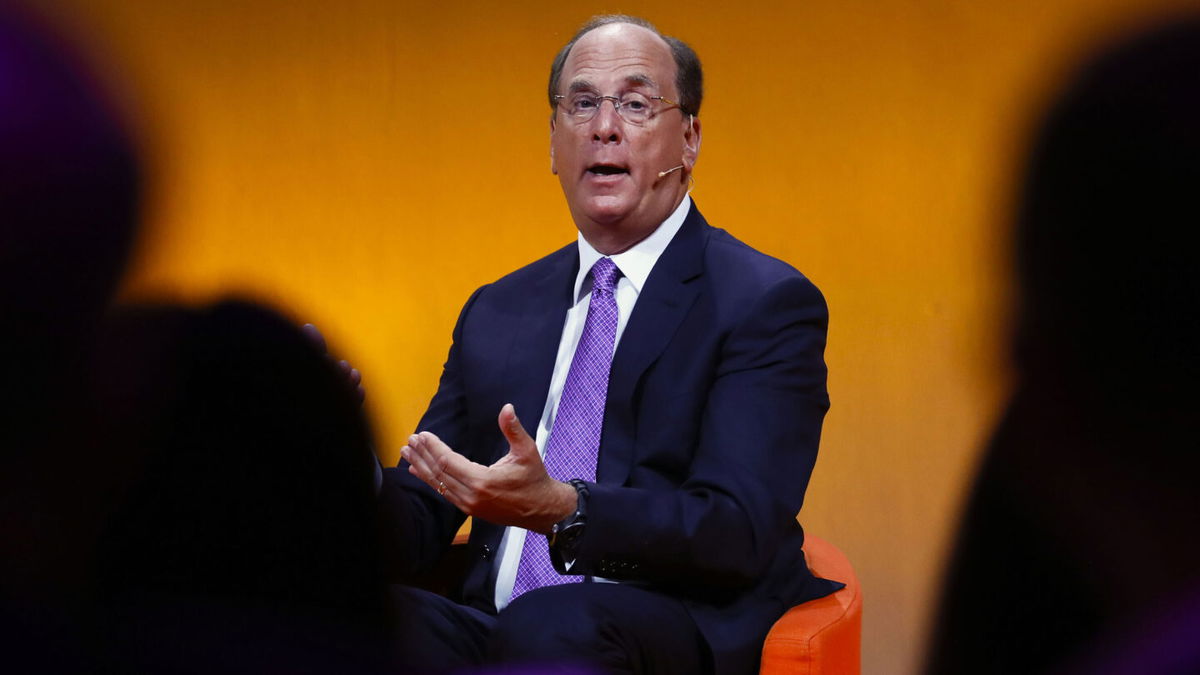

Every year, BlackRock CEO Larry Fink, one of the most powerful people in global finance, pens a letter to chief executives that’s required reading for business leaders.

Fink’s insistence that companies need to disclose more about their climate plans and seriously consider their role in society has helped change what’s expected of Corporate America.

His views have also drawn criticism. Some on the political right claim Fink goes too far in telling businesses to be socially and environmentally conscious. Others on the left say he isn’t going far enough.

In his latest letter to CEOs published Tuesday, Fink has issued a response that amounts to: I’m just a capitalist.

The push for companies to reassess their priorities is “not about politics,” he said.

“It is not a social or ideological agenda. It is not ‘woke,'” Fink wrote. “It is capitalism.”

Fink said companies need to set short, medium and long-term targets to reduce greenhouse gas emissions because doing so is “critical to the long-term economic interests” of shareholders.

He also said it’s crucial that leaders take a stand on issues important to employees and customers.

“It’s never been more essential for CEOs to have a consistent voice, a clear purpose, a coherent strategy and a long-term view,” Fink wrote. “Your company’s purpose is its north star in this tumultuous environment.”

Fink said that BlackRock does not advocate for widespread divestment from oil and gas companies, since there are firms in the industry making changes that will be essential to achieve net-zero emissions. Plus, “governments and companies must ensure that people continue to have access to reliable and affordable energy sources,” he added.

“Any plan that focuses solely on limiting supply and fails to address demand for hydrocarbons will drive up energy prices for those who can least afford it, resulting in greater polarization around climate change and eroding progress,” Fink said.

Why it matters: BlackRock is the world’s biggest money manager, ending last year with more than $10 trillion under management. That means the company has huge influence over how billions of dollars are allocated, and can sway other firms as they set policy.

BlackRock’s commitment to net-zero emissions by 2050 and socially-minded business priorities has been important. But Fink’s stance that companies both need to step up and “cannot be the climate police” is set to continue to draw critics from across the political spectrum.

One more thing: Fink also addressed the changing relationship between employers and employees as the rate of workers quitting their jobs stands at a record high in the United States.

“Companies not adjusting to this new reality and responding to their workers do so at their own peril,” he said. “Turnover drives up expenses, drives down productivity and erodes culture and corporate memory. CEOs need to be asking themselves whether they are creating an environment that helps them compete for talent.”

Stocks fall as benchmark US Treasury yield hits 2-year high

The yield on the benchmark 10-year US Treasury note jumped to its highest level in two years early Tuesday, rattling investors who were already on edge about how policymakers will respond to high inflation.

The latest: US stock futures were sharply lower in premarket trading as Wall Street eyed the turbulence in the bond market.

Government bond yields, which move opposite prices, have risen dramatically since the start of the year as investors brace for the Federal Reserve to respond more aggressively to the spike in consumer prices, which are rising at the fastest pace in nearly four decades.

Fed officials have indicated in recent days that they’d be willing to hike interest rates more than three times this year if needed. While borrowing costs would remain near historic lows, that would mark a notable shift after a long period of rock-bottom rates.

In a Deutsche Bank survey of roughly 500 market participants published Tuesday, higher-than-expected inflation and a more hawkish Fed tightening cycle were identified as the two biggest risks to market stability.

The VIX, a measure of US market volatility, rose almost 13% this morning to its highest level so far this year.

Over the weekend, billionaire investor Bill Ackman recommended on Twitter that the Fed initially hike rates by 0.5% instead of by 0.25% as expected in order to “restore its credibility” and “demonstrate its resolve on inflation.”

“The Fed is losing the inflation battle and is behind where it needs to be, with painful economic consequences for the most vulnerable,” Ackman said.

Ben & Jerry’s, meet Aquafresh and Advil

Unilever is willing to pay big money for the company that makes products like Advil, Tums and Aquafresh toothpaste as it tries to revive its sluggish stock and ramp up its focus on health products.

GlaxoSmithKline said over the weekend that it had received three “unsolicited” proposals from Unilever to acquire its consumer healthcare business, which it runs as a joint venture with Pfizer. The latest had a price tag of £50 billion ($68 billion).

No deal yet: GSK has rejected the offers, which it said were too low. It’s planning to spin off the division later this year, under pressure from shareholders including hedge fund Elliott Investment Management.

Unilever could still sweeten its bid. The company said Monday that it’s pursuing a strategic overhaul that would involve expanding its portfolio of health, beauty and hygiene products. More details will be announced by the end of the month.

But investors aren’t thrilled about the idea. Unilever’s shares fell 7% in London on Monday and are down another 2% in early trading on Tuesday.

On the radar: Analysts at Berenberg said that Unilever should be careful about pivoting away from its food and drink business, which they said “actually offers some of Unilever’s most attractive categories,” such as ice cream and cooking ingredients.

Up next

BNY Mellon, Goldman Sachs, PNC and Truist report results before US markets open. J.B. Hunt follows after the close.

Also today:

- The Empire State Manufacturing Index posts at 8:30 a.m. ET.

- The NAHB Housing Market Index follows at 10 a.m. ET.

Coming tomorrow: Earnings from Bank of America, Morgan Stanley, Procter & Gamble and United Airlines.

The-CNN-Wire

™ & © 2022 Cable News Network, Inc., a WarnerMedia Company. All rights reserved.