SoftBank’s CEO went big on China. Now he’s pulling back

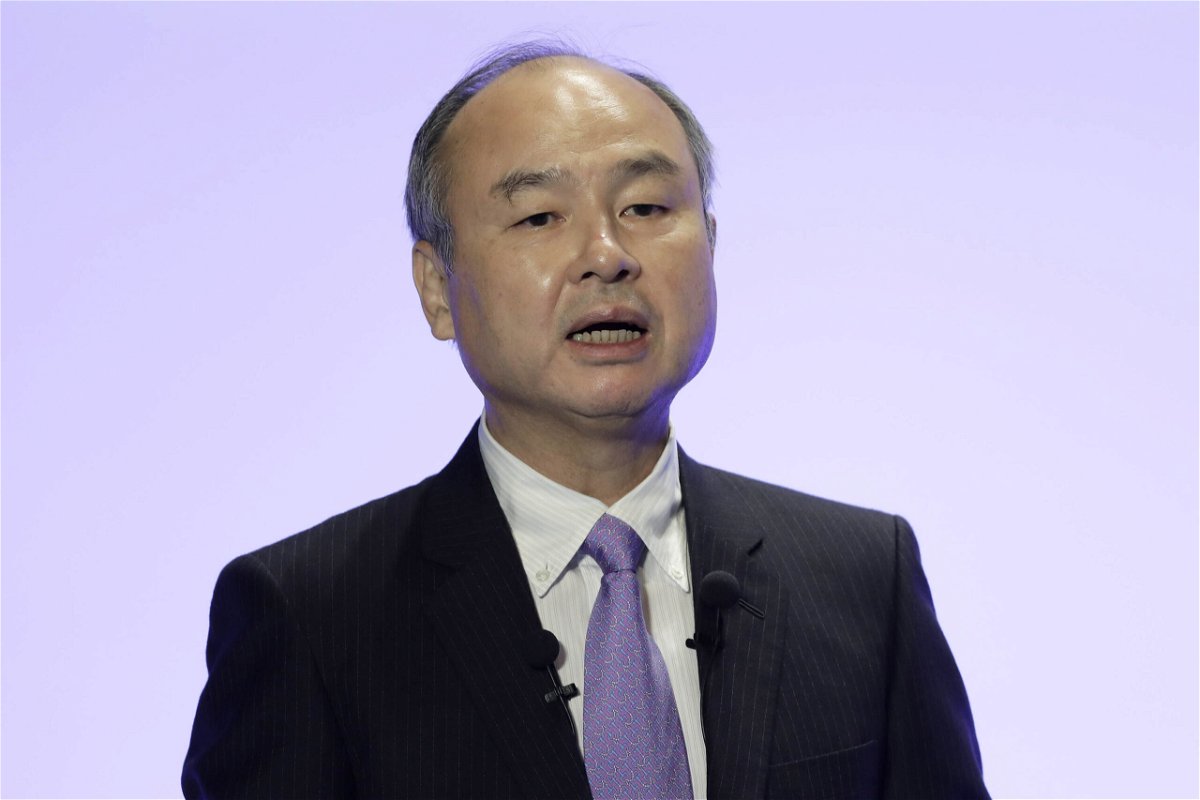

SoftBank CEO Masayoshi Son is cutting back on new investments in China as the country's private sector continues to face a historic regulatory crackdown.

By Michelle Toh, CNN Business

SoftBank CEO Masayoshi Son is cutting back on new investments in China as the country’s private sector continues to face a historic regulatory crackdown.

The Japanese billionaire said at an earnings presentation Tuesday that he would take a cautious approach until the impact of new regulations are clear.

Chinese companies accounted for 23% of SoftBank’s massive Vision Fund investment portfolio at the end of July. But only 11% of Vision Fund investment has been directed to the country since April, Son said.

“It’s because we would like to wait and see a while,” he added.

Taking questions from reporters, Son acknowledged that the company was “facing tough challenges when it comes to investments in China.”

“That’s true,” he said. “That’s something we’d like to be careful about, and be cautious. Once we have a better view, then we’d like to resume [further] investments.”

In recent months, China has embarked on a major clampdown on private enterprise, which has engulfed some of the country’s top players. Initially, it appeared that regulators’ main target was the booming tech sector, but lately that has expanded to reach other industries, such as private education.

Investors have been rattled. So far, the events have wiped out more than $1.2 trillion in market value and stoked fears about the future of innovation in the world’s second largest economy. Son said he was concerned about the the impact regulations would have on stock markets.

SoftBank, one of the world’s largest tech investors, holds stakes in several top Chinese firms, including e-commerce titan Alibaba, ride-hailing giant Didi and TikTok owner ByteDance.

Didi has especially felt the pain lately, with an initial public offering in the United States that went downhill after Beijing launched a probe into the company and banned it from Chinese app stores.

Son did not comment on Didi specifically during the presentation, but said that he still had “good expectations” from SoftBank’s portfolio companies in China.

He reiterated that the firm wanted to “wait and see how things go” as regulations continued to roll out, adding that there was no specific timeline on how long it planned to take that approach.

“Is it six months, 12 months? I don’t know yet,” the executive said.

“[But] in one year or two years, under the new rules, and under new orders, I think things will be much clearer … Once things get clearer, then we are open to resuming active investment.”

Son’s remarks came as SoftBank posted a nearly 40% drop in profits Tuesday. Net income fell to 761.5 billion yen ($6.9 billion) in the quarter ended June compared to the same period a year ago.

The company largely attributed that to a major one-off gain it received last year based on the merger of Sprint — which Son had bought in 2013 — and T-Mobile.

Despite the crackdown, Son said he remains bullish on China in the long run.

“There are still risks out there, like the risks in China. But we want to take risks,” he said. “We are not against or for the Chinese government, and we don’t have any doubt about [the] future potential of China.”

— Laura He contributed to this report.

The-CNN-Wire

™ & © 2021 Cable News Network, Inc., a WarnerMedia Company. All rights reserved.