Regulators open probe into red hot ‘buy now, pay later’ industry

Consumer Financial Protection said Thursday that it is looking to "collect information on the risks and benefits of these fast-growing loans" from five leading BNPL companies.

By Paul R. La Monica, CNN Business

Regulators in Washington may crack down on the industry behind “buy now, pay later,” the increasingly popular method for consumers to purchase things online.

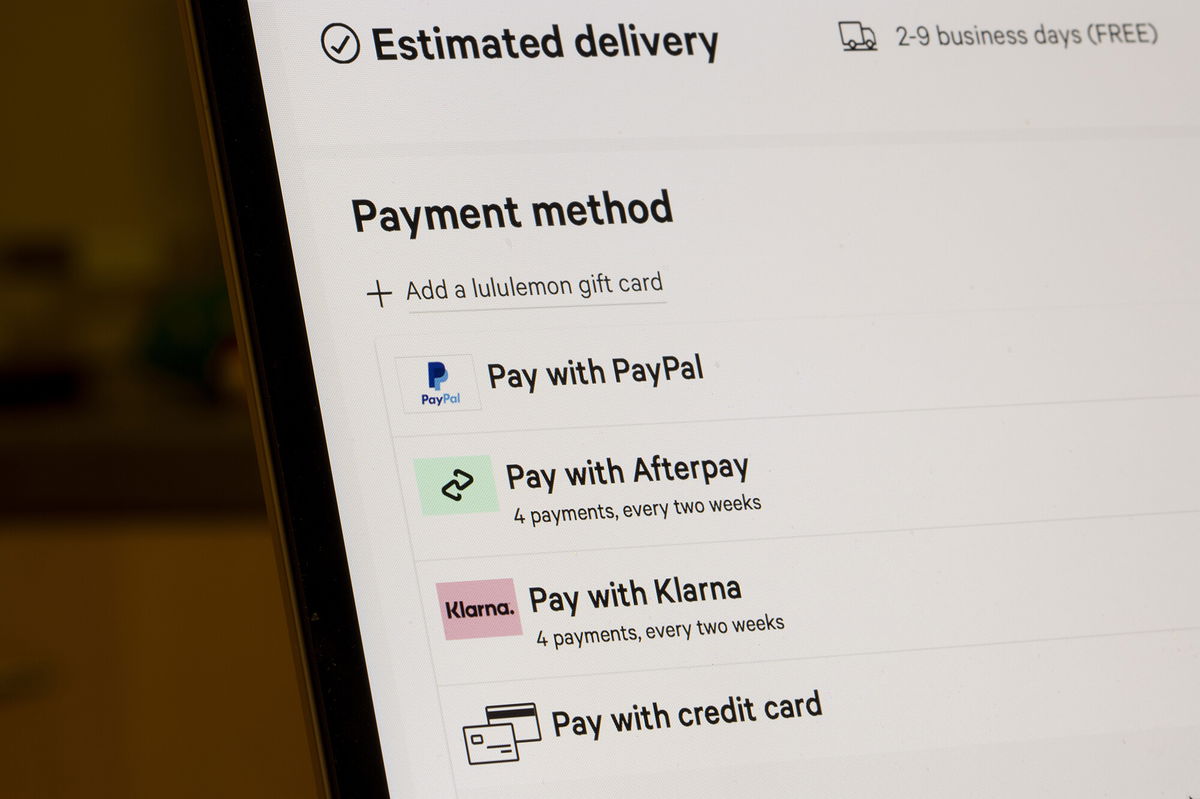

The Consumer Financial Protection Bureau said Thursday that it is looking to “collect information on the risks and benefits of these fast-growing loans” from five leading BNPL companies: Affirm; Australia’s Afterpay, which is getting bought by Square owner Block; PayPal; privately held Swedish fintech Klarna; and Zip, another BNPL firm headquartered in Australia.

Shares of Affirm, which went public in January, plunged more than 10% following the CFPB news. Block shares fell about 5%, but that drop may also have something to do with a lawsuit filed against it by tax preparer H&R Block. PayPal was down slightly.

“Buy now, pay later is the new version of the old layaway plan, but with modern, faster twists where the consumer gets the product immediately but gets the debt immediately too,” said CFPB Director Rohit Chopra in a statement Thursday.

The CFPB said it was specifically worried about how quickly consumers can accumulate debt using BNPL services and also about how the BNPL companies may harvest data about their customers. It added that it is working with international partners in Australia, Sweden, Germany and the United Kingdom on the inquiry.

The announcement comes one day after six Democratic US senators on the Committee on Banking, Housing, and Urban Affairs, including Elizabeth Warren, wrote a letter to the CFPB, urging it to look into potentially abusive practices in the industry.

“While the emergence of BNPL as affordable small-dollar credit has potentially provided an alternative to more costly forms of credit, these products also have the potential to cause consumer harm,” the senators wrote.

“Nonbank BNPL providers currently operate without meaningful oversight. They are not generally subject to federal supervision that can spot unfair, deceptive, or abusive practices or other violations of federal consumer protection laws,” the senators added, noting that “consumers may be unaware of these regulatory gaps and may be erroneously led to believe that credit obtained from a BNPL provider comes with protections that are similar to those for credit cards.”

BNPL has been a big trend in the financial services world this year. Affirm shares have nearly doubled from their initial public offering price, even after factoring in Thursday’s drop. The company announced a deal with Amazon in August.

And Klarna is one of the world’s most valuable privately held startups. With a recent valuation of $45.7 billion, Klarna is one of the more eagerly awaited potential IPOs of 2022.

A spokesperson for Affirm said in an email to CNN Business that “we welcome the CFPB’s review and support regulatory efforts that benefit consumers and promote transparency within our industry”.

The Affirm spokesperson added that the company has “never charged a late or hidden fee, ever” and that “we will continue to engage with all of our stakeholders, including regulators, to support efforts that advance our mission.”

A spokesperson for Klarna told CNN Business that “we believe proportionate regulation is a good thing and set the standard by providing consumers with an interest free, fair and sustainable alternative to credit cards.”

“Through this process, we believe those benefits will be made abundantly clear and will continue our work with regulators to inform them about how our products are structured, used, and benefit both consumers and retailers,” the Klarna spokesperson added.

An Afterpay spokesperson said to CNN Business that the company “welcomes efforts to ensure that there are appropriate regulatory protections for consumers in the diverse BNPL industry, and that providers are meeting high standards and delivering positive consumer outcomes while protecting their data,” adding that “Afterpay provides consumers with better transparency, lower costs, and better budgeting tools than traditional forms of credit and promotes responsible spending.”

For its part, a PayPal spokesperson told CNN Business that “our customers trust us to be transparent and we take this responsibility very seriously. PayPal is reviewing the letter and we will continue to work productively with the CFPB to provide information as requested.”

Zip said in a statement Thursday night that “has always believed in transparency and we welcome the opportunity to continue sharing insights with the CFPB’s research and markets division. We have a shared mission to prioritize consumer financial wellbeing and as such we applaud the CFPB’s dedication to consumer protection.”

It went on to say that the company “already abides by a number of federal and state regulations and we will continue to prioritize regulatory compliance as we create consumer-friendly products and services.”

Block was not immediately available for comment.

The-CNN-Wire

™ & © 2021 Cable News Network, Inc., a WarnerMedia Company. All rights reserved.